Inflation continues to impact consumers and policymakers in negative ways. Hedging through broad commodities has proven to buffer portfolio returns, with the S&P GSCI up 5.38% this year. Going into the year, expectations of Fed rate cuts and continued declines in the Consumer Price Index (CPI) pushed inflation concerns aside. Since then, markets have experienced increased inflation figures and downsized rate cut bets. Commodities make up over one-third of the CPI, providing a direct hedge against upside inflation surprises. Americans have been spending more on food as a percentage of disposable income since the 1980s. The USDA’s most recent report1 highlights that 11.3% of income is being spent on food. The Fed may overlook volatile food and energy, preferring to focus on the Personal Consumption Expenditures Index (PCE), but even the PCE has followed the traditional CPI levels in its trend higher. More importantly, the S&P GSCI has historically tended to outperform when inflation surprises to the upside.

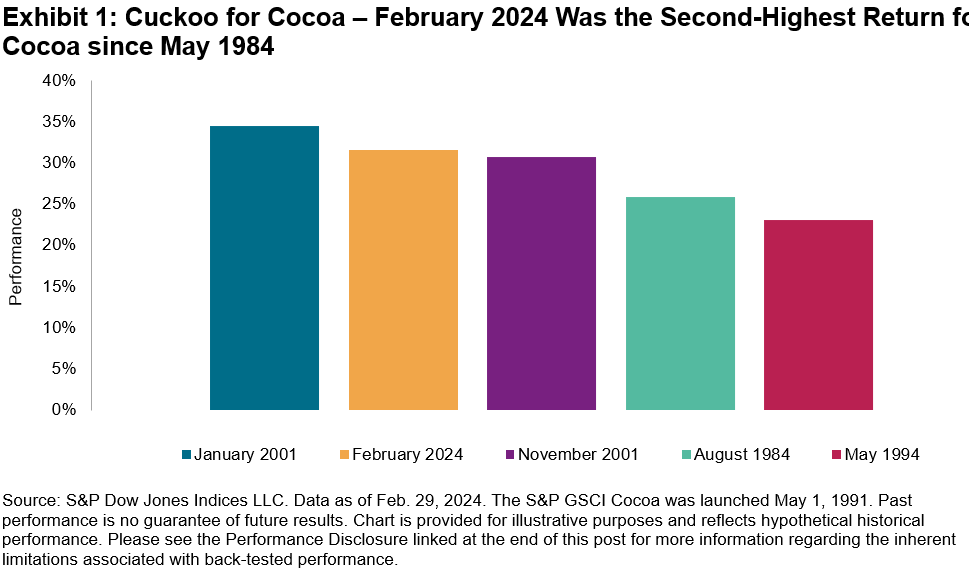

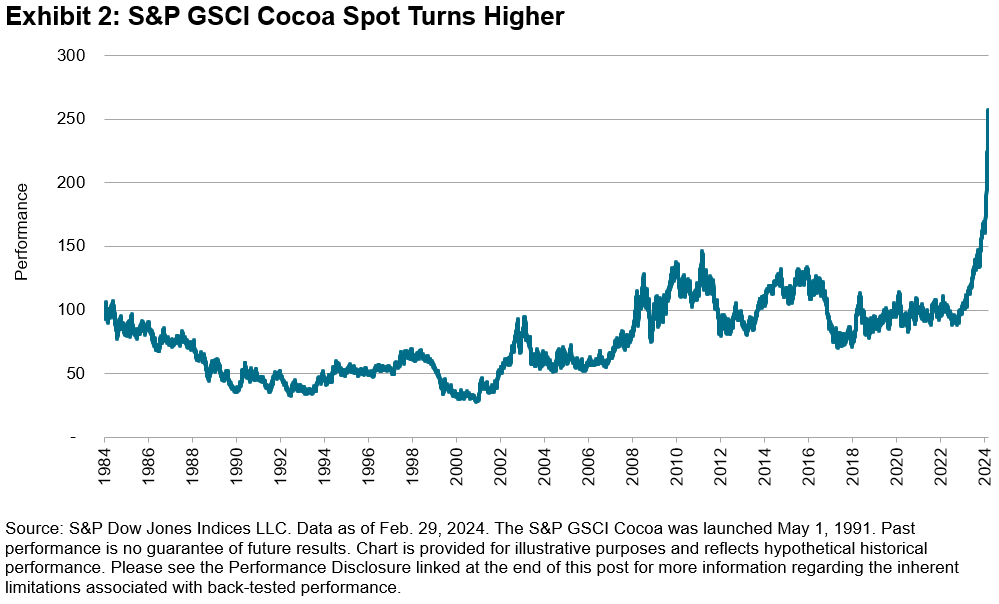

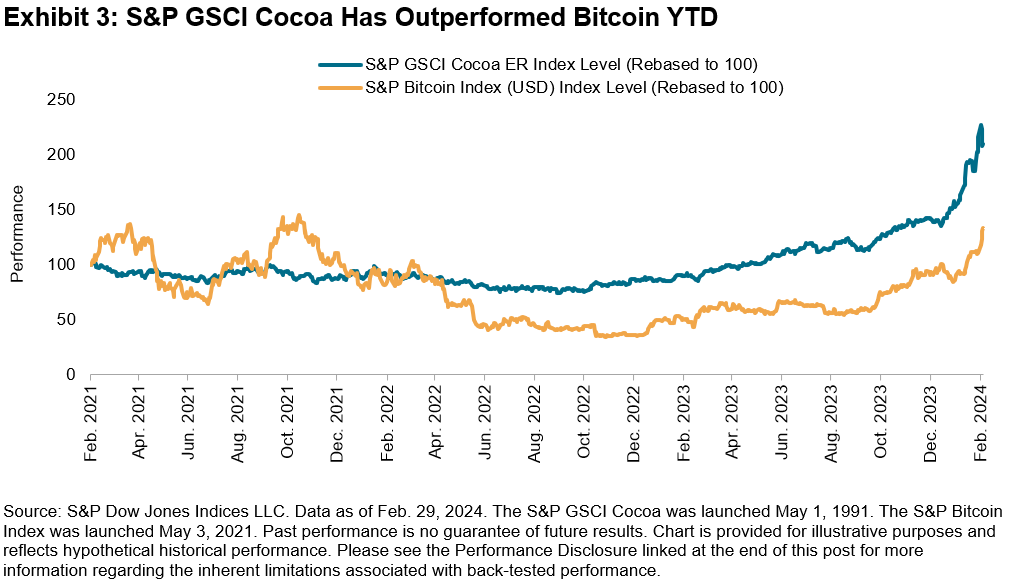

Fueled by hedge fund speculation, cocoa prices surged over 32% during the month to an all-time high and futures markets reported USD 8.7 billion in speculative cocoa contracts. Political instability and declining crop yields in West Africa cast a similar picture last seen during the 2001 bull run-up in cocoa, the best year on record dating back to 1984. On the heels of a 61% return in 2023, cocoa is up an additional 51% in 2024, even outperforming the S&P Bitcoin Index, which is up a paltry 47.5%.

The posts on this blog are opinions, not advice. Please read our Disclaimers.