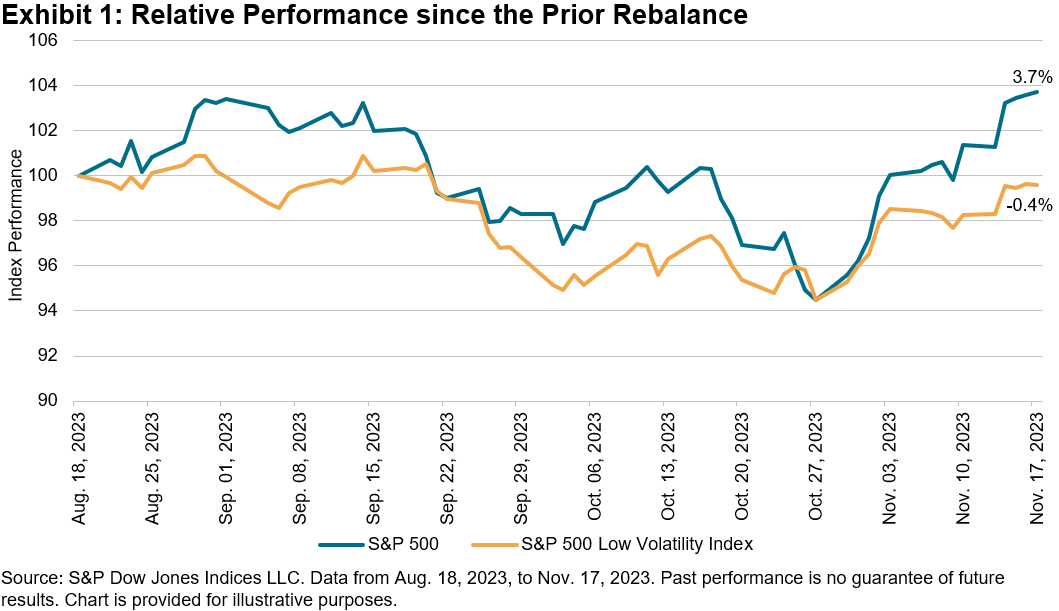

The S&P 500® continued its strong performance this year after posting a 9.8% gain in a span of less than three weeks from Oct. 30 to Nov. 17, 2023. During this period, the 10-year U.S. Treasury yield dropped approximately 45 bps1 and October’s year-over-year headline CPI inflation cooled to 3.2%.2 As Exhibit 1 shows, since the previous rebalance for the S&P 500 Low Volatility Index on Aug. 18, 2023, through the most recent rebalance on Nov. 17, 2023, the S&P 500 was up 3.7%, versus a decline of 0.4% for the S&P 500 Low Volatility Index. This type of divergence can happen especially during periods of strong performance and low volatility for the S&P 500. During this period, the annualized daily standard deviation for the S&P 500 was a relatively low 13.6%.

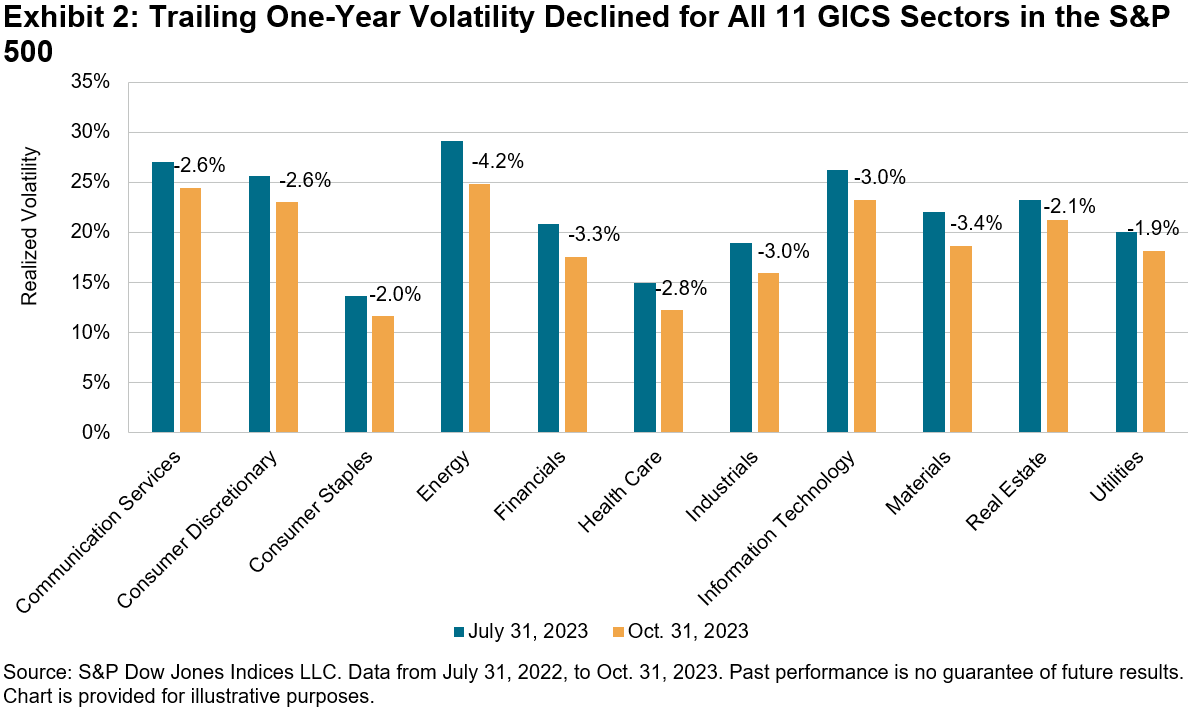

As Exhibit 2 shows, the trailing one-year volatility decreased for all 11 GICS sectors from July 31, 2023, to Oct. 31, 2023. The widespread decline in volatility across all 11 GICS sectors followed the same pattern in the three months prior to this period. Measured in absolute terms, volatility decreased the most for the Energy sector, although it remained the most volatile sector at 24.9%. As of Oct. 31, 2023, Consumer Staples was the least volatile sector, with a daily realized volatility of only 11.6%.

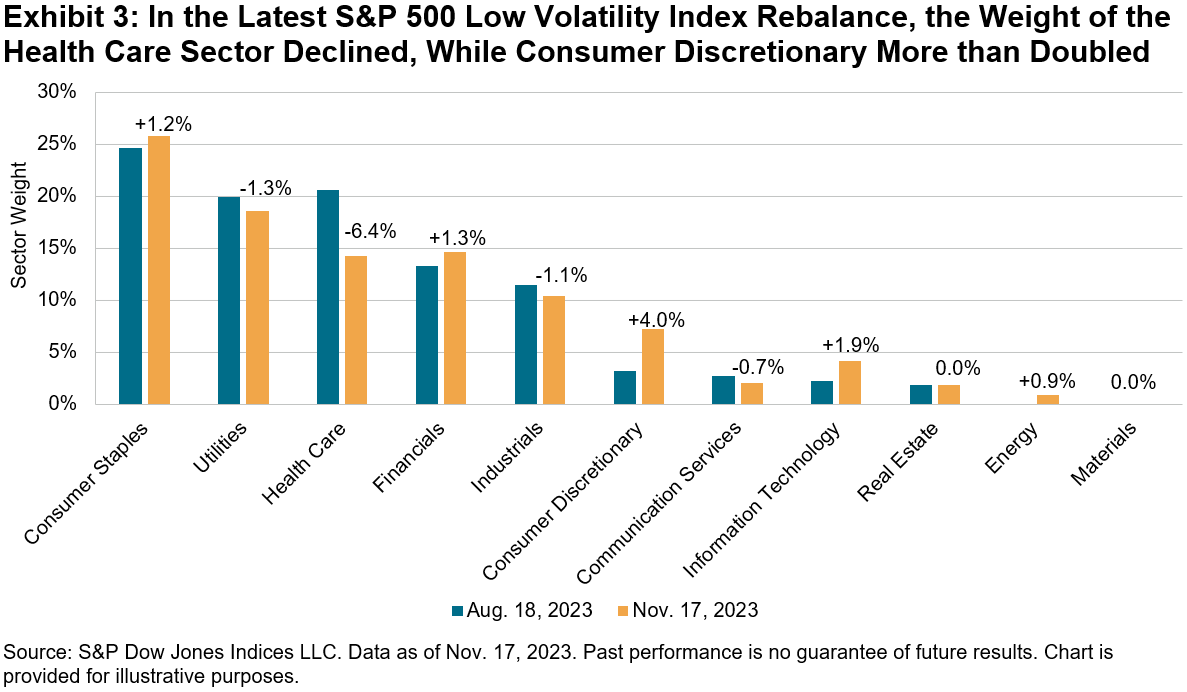

Amid the overall decrease in volatility, the latest rebalance of the S&P 500 Low Volatility Index brought some material changes to sector weightings, most notably in the Health Care and Consumer Discretionary sectors.

Following the most recent rebalance, Health Care’s weight dropped by 6.4%. Approximately 4.0% shifted to the Consumer Discretionary sector, more than doubling its weight to 7.3%. Other notable recipients were the Information Technology sector, which saw its weight almost double from 2.3% to 4.2%, as well as the Consumer Staples sector, which increased its weight to 26%.

After the Energy sector received a small allocation of approximately 1%, the Materials sector is now the only sector with no allocation in the S&P 500 Low Volatility Index. The latest rebalance became effective after the market close on Nov. 17, 2023.

1 https://fred.stlouisfed.org/series/DGS10

2 https://www.bls.gov/news.release/cpi.nr0.htm

The posts on this blog are opinions, not advice. Please read our Disclaimers.