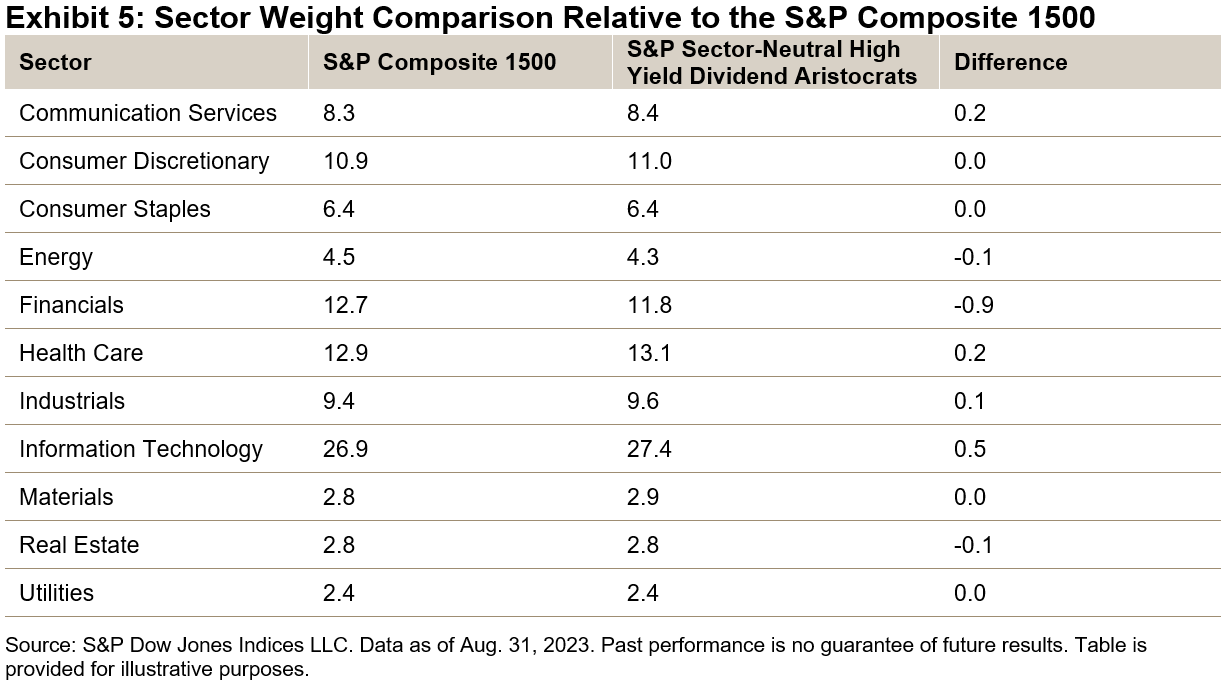

The first half of 2023 saw a strong rebound from 2022 for equities: the S&P 500® gained 17% as the U.S. outperformed the S&P Global Ex-U.S. BMI (up 10%). Information Technology led the way across the U.S. cap spectrum, possibly reflecting investors’ expectations regarding the potential impact of artificial intelligence.

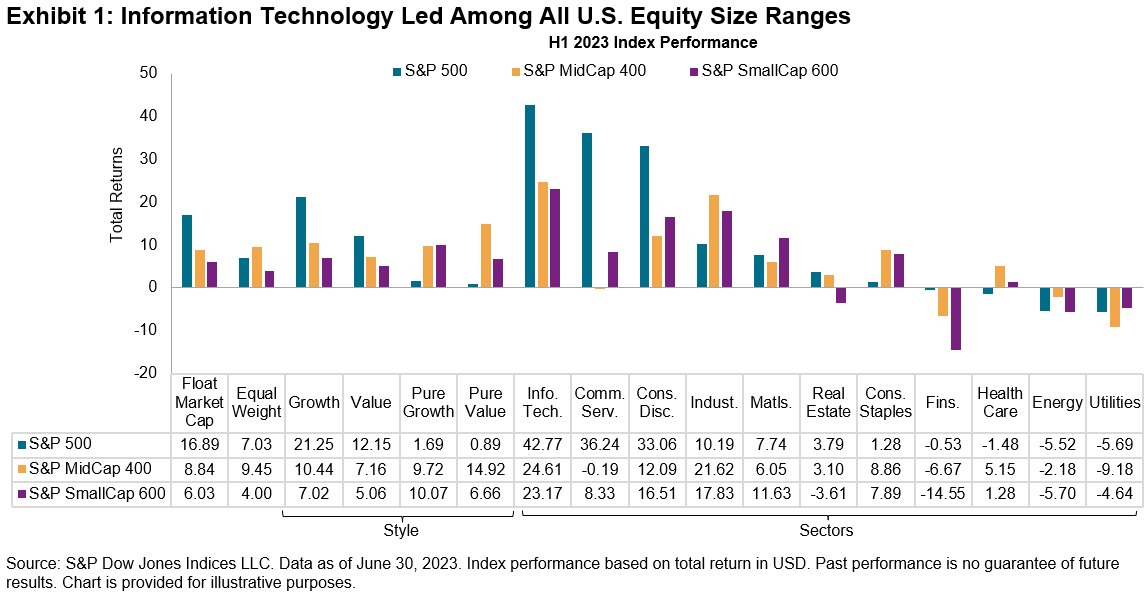

The S&P Composite 1500® combines the S&P 500, S&P MidCap 400® and S&P SmallCap 600®, representing the investable portion of the large-, mid- and small-cap U.S. equity market, respectively. While other index series like the MSCI USA Investable Market Index (IMI), Russell 3000 and CRSP US Total Market aim to measure the U.S. market, differences in index construction can lead to clear distinctions in size and composition, as illustrated by Exhibit 2.

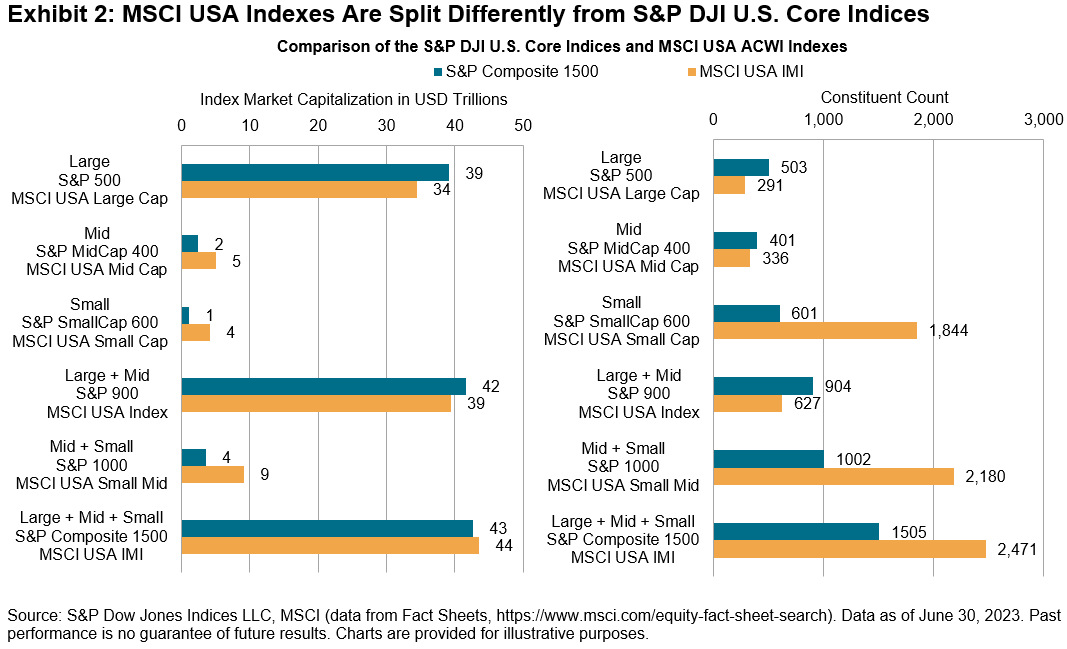

S&P DJI U.S. Core Equity Indices underperformed their MSCI USA Index counterparts in H1 2023, typically driven by a lower exposure to Information Technology, which was the best performing sector. However, when looking at 20-year and nearly 30-year time horizons, S&P DJI U.S. Core Equity Indices typically outperformed in the long-term.

One relative bright spot for the S&P DJI U.S. Core Equities in H1 2023 was the S&P MidCap 400. Despite the S&P 400® having a lower exposure to Information Technology than MSCI USA Mid Cap of 5.4%, the S&P 400 outperformed by 2% in H1 2023, extending its 2022 outperformance of 5%. The S&P 400 also outperformed the S&P 500 Equal Weight Index by nearly 2%.

There are several potential candidates to explain the S&P 400’s relative performance versus the MSCI USA Mid Cap Index. For example, size, earnings screen and sector exposures. To better understand some of these factors, we conducted an analysis comparing the relative size, sector and stock selection effects between the two mid-cap indices.

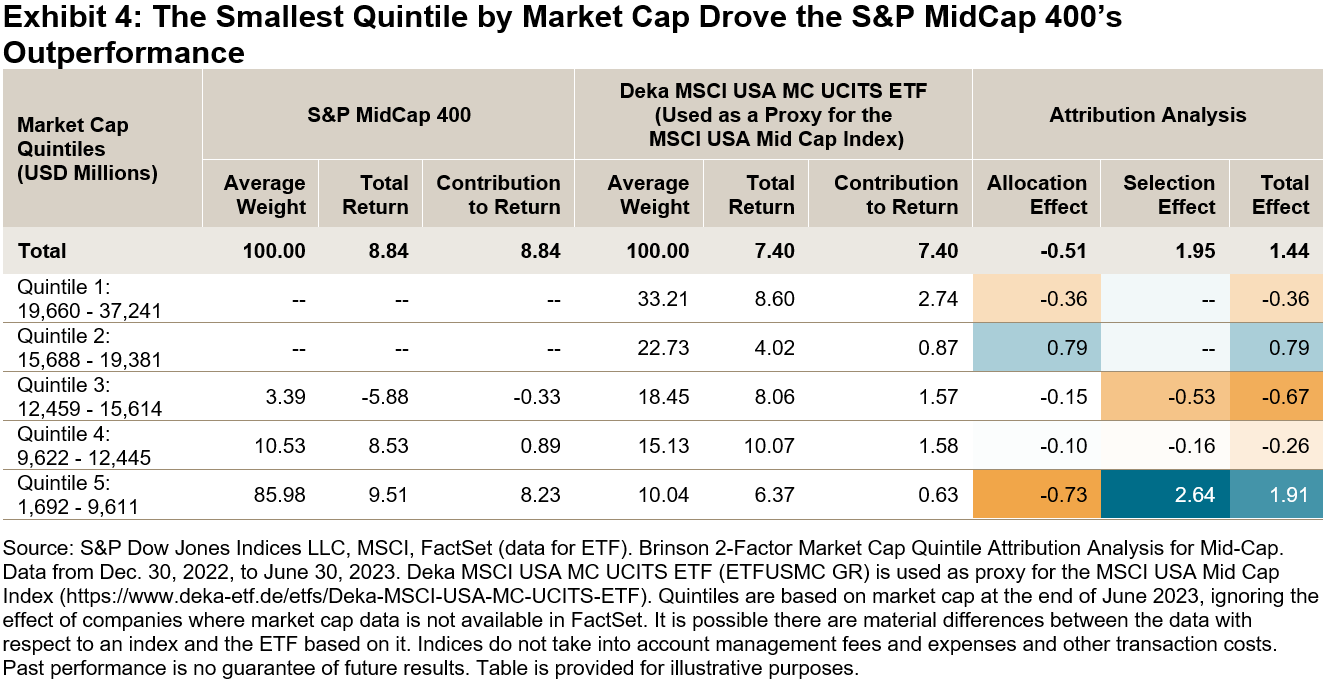

Overall, the choice of companies within S&P 400 sectors mattered more than the sector and size exposures in isolation. When splitting our two universes into quintiles, Exhibit 4 shows that more than 50% of the MSCI USA Mid Cap Index belonged to the largest two size quintiles at the end of H1 2023. The total allocation effect in H1 2023 was negative. In contrast, the S&P MidCap 400 had more exposure to the smallest quintiles, with the selection effect in the Quintile 5 driving its outperformance in the first half 2023.

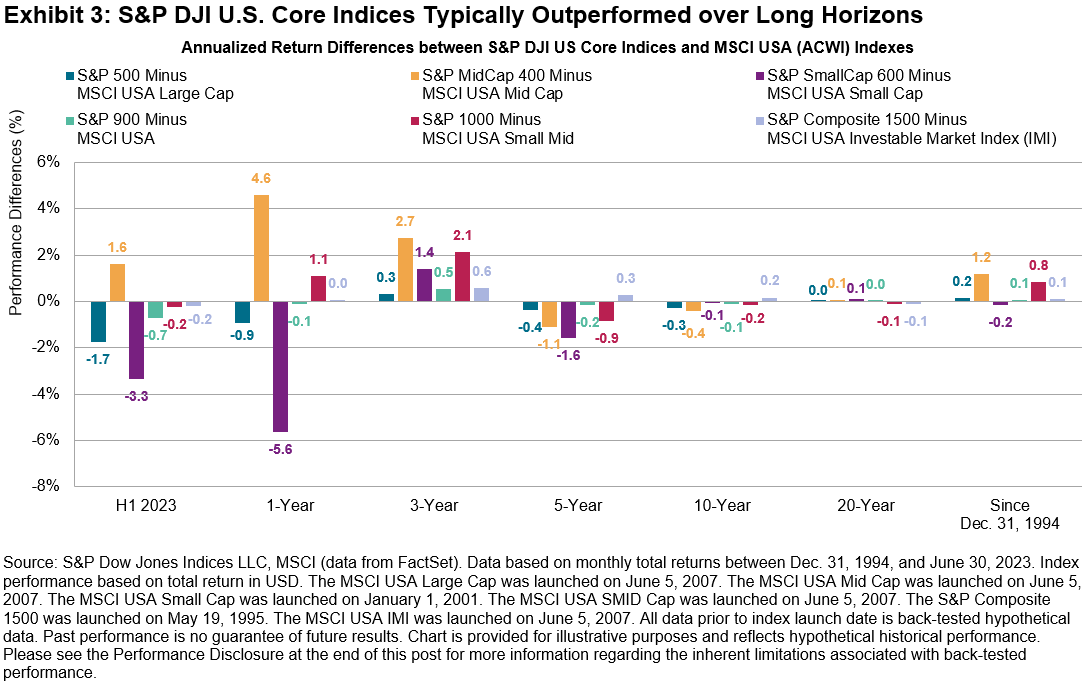

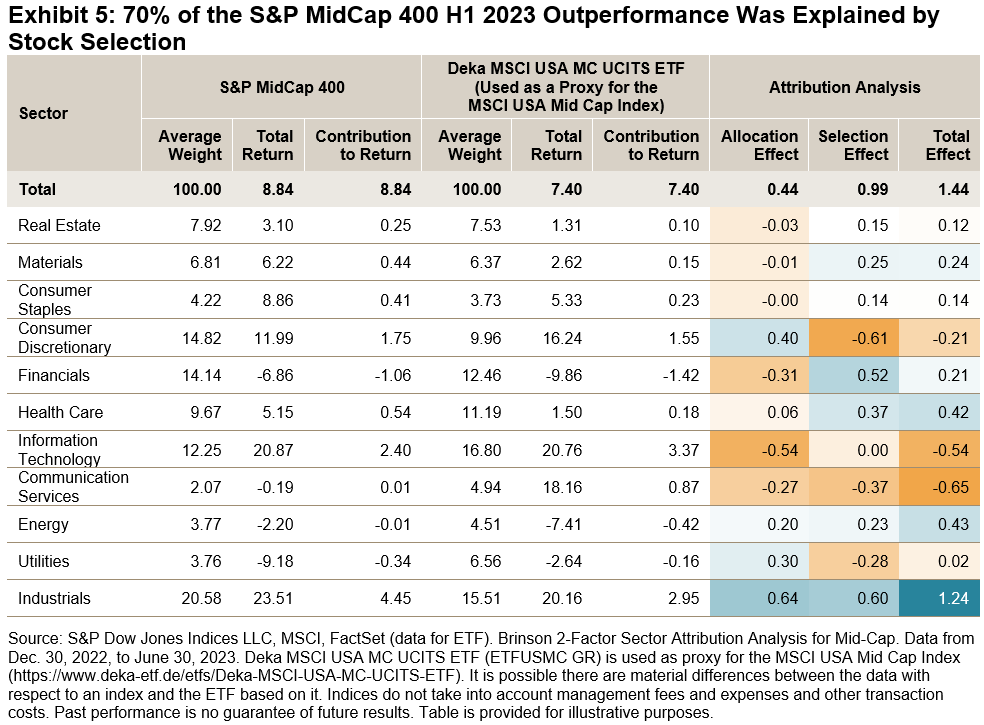

The choice of stocks explained 70% of the S&P 400’s relative outperformance. Exhibit 5 shows the Two-Factor Brinson Attribution of the S&P 400 against the MSCI USA Mid-Cap Index by GICS® Sector and analyzes how much of the S&P 400’s H1 2023 relative return can be explained by differences in sector exposures (allocation effect) versus the choice of constituents in each sector (the selection effect). When looking at sectors, a lower exposure to Information Technology detracted from performance, an overweight to Industrials was one component to outperformance in H1 2023, which rose 22% in H1 as shown in Exhibit 1. However, in several instances the allocation effect of sectors was neutral or negative (e.g., Financials), but a strong selection effect (choice of stocks) within sectors in those instances meant that the total effect was positive.

While both index series are designed to measure the performance of large, mid and small size segments and various combinations of the U.S. equity market, differences in defining the size split and index construction (such as the S&P Composite 1500’s earning screen) have historically resulted in contrasting size exposure, index characteristics and performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.