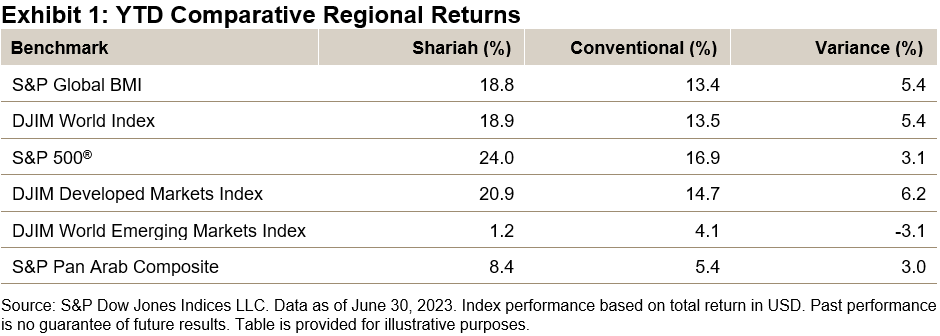

Global equities ended the second quarter of the year with a gain of 6.0%, as measured by the S&P Global BMI, accumulating gains of 13.4% YTD. Shariah-compliant benchmark returns, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, outperformed their conventional counterparts by about 1.5% during the quarter, building on momentum from the first quarter of the year.

Regional broad-based Shariah and conventional equity benchmarks had a positive quarter across the board. The Shariah-complaint developed markets benchmark stood out for its performance against the conventional benchmark YTD, while the Shariah-compliant emerging markets index stood out as an exception to the performance trend and continued to lag the conventional benchmark (see Exhibit 1).

Drivers of Shariah Index Performance YTD in 2023

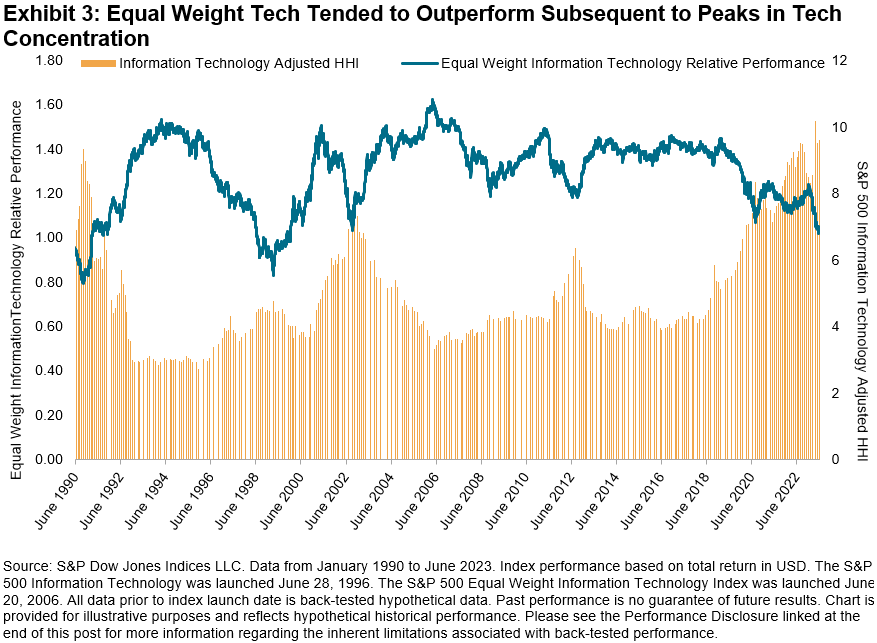

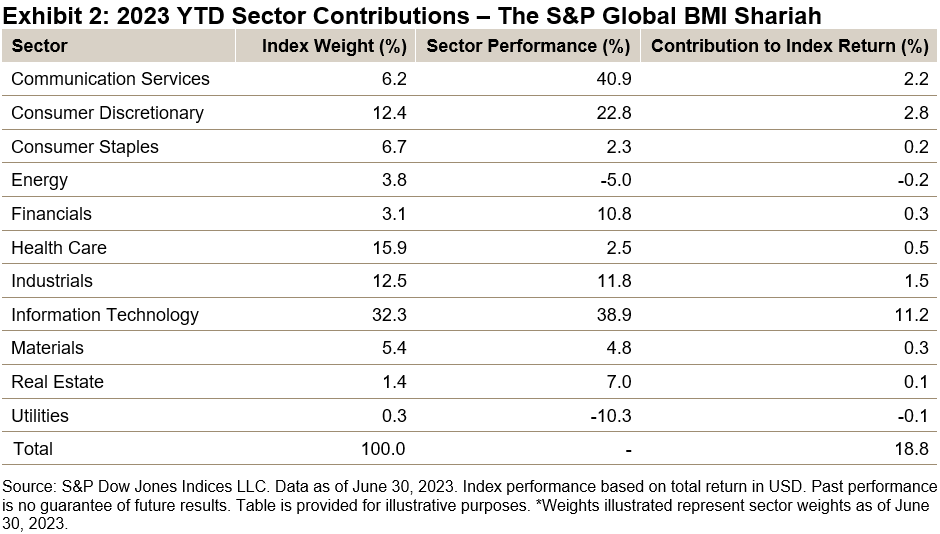

Shariah benchmarks continued to outperform their conventional counterparts YTD, in contrast to 2022 returns. Sector composition can provide some explanation for the results during this period. A higher exposure to Information Technology stocks within Islamic indices and no exposure to conventional financial services including banks, were the main drivers of this outperformance. The Information Technology sector was up nearly 39% and represented nearly one-third of the index weight, driving the highest return contribution among all sectors (see Exhibit 2).

Meanwhile Communication Services and Consumer Discretionary also had outsized returns among sectors, which contributed significantly to the index’s outperformance despite lower representation in comparison to the largest sectors.

Energy and Utilities were the only sectors that decreased YTD. The impact from these was limited by their small weights.

MENA Equities Turn Around in Q2 2023

Following negative performance during Q1, MENA equities gained nearly 6% during Q2, as measured by the regional S&P Pan Arab Composite. GCC country performance largely followed suit, with positive returns for Saudi Arabia (8.0%), UAE (6.3%) and Kuwait (0.1%), while Bahrain surged (13.8%). Meanwhile, Qatar (-1.3%) and Oman (-0.3%) posted losses.

For more information on how Shariah-compliant benchmarks performed in Q2 2023, read our latest Shariah Scorecard https://www.spglobal.com/spdji/en/documents/performance-reports/scorecard-sp-shariah-djim.pdf

This article was first published in IFN Volume 20 Issue 28 dated July 12, 2023.

The posts on this blog are opinions, not advice. Please read our Disclaimers.