A sizzling start for Canadian equities in 2023 found itself fizzling as March began. Despite having a return of as much as 7% in late January/early February, through March 17, 2023, the S&P/TSX Composite Index was up 0.7% YTD. In line with historical trends, the S&P/TSX Composite Low Volatility Index underperformed, declining 0.1%.

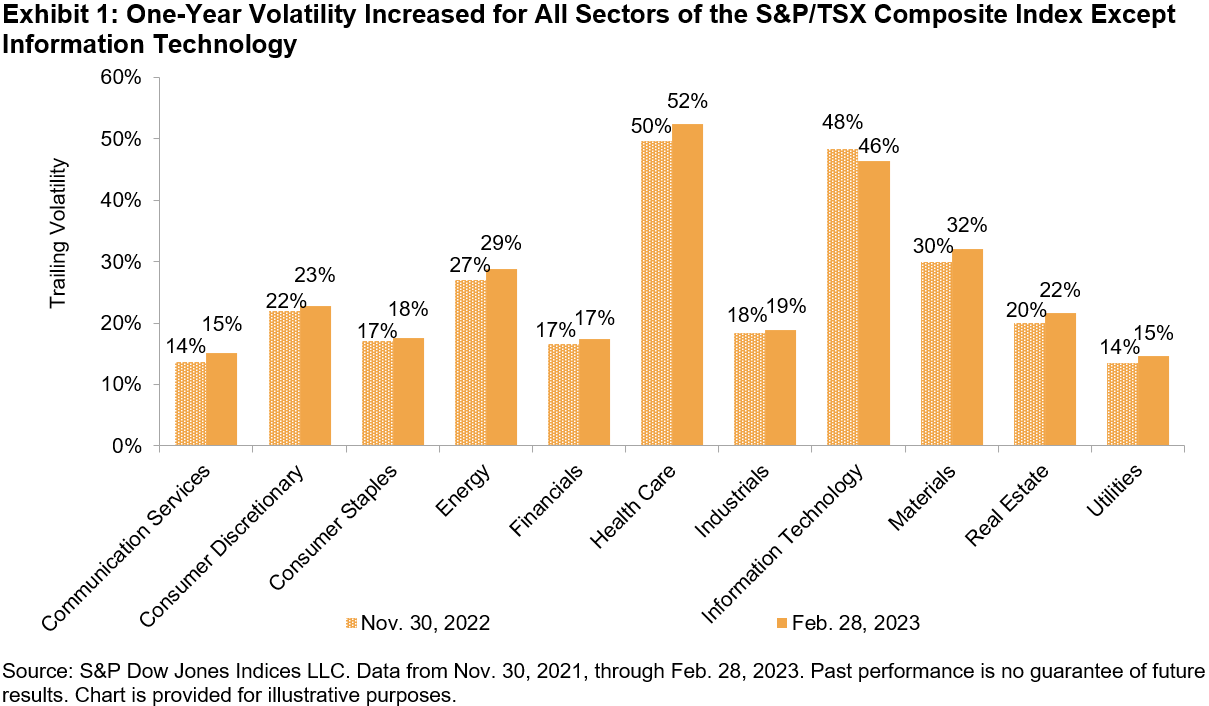

Volatility rose for every sector of the S&P/TSX Composite Index except for Information Technology, which, nonetheless, remains the second most volatile sector, preceded only by Health Care.

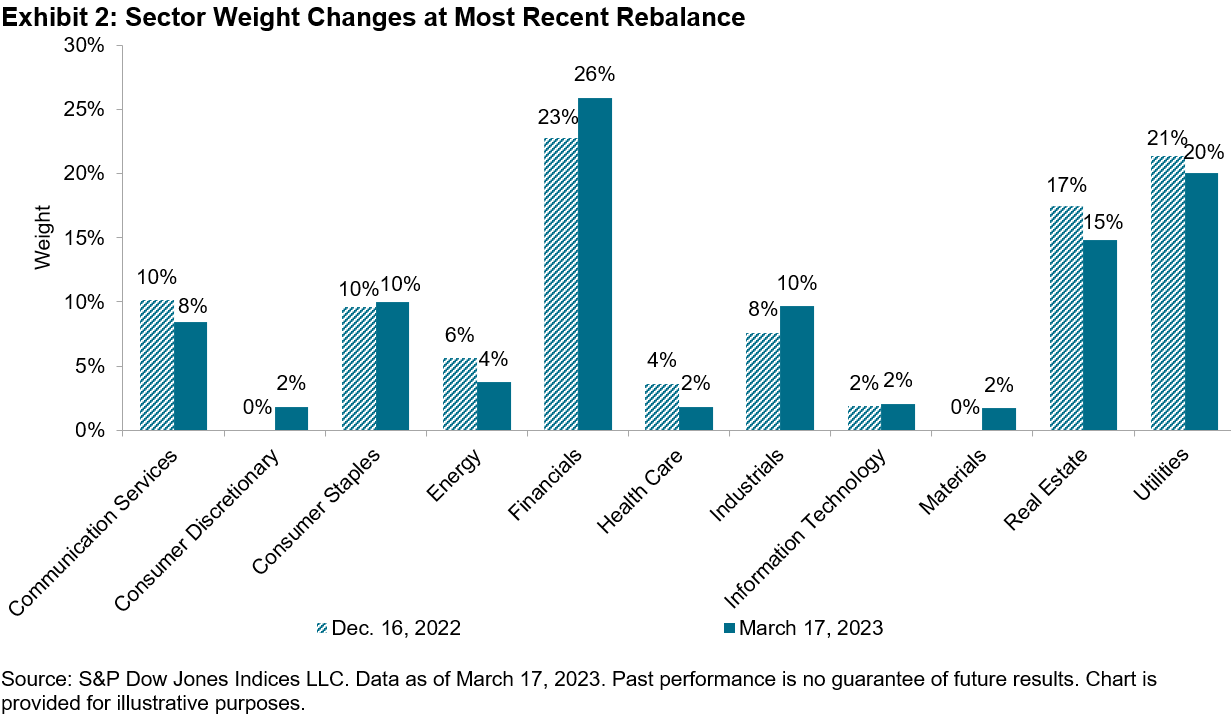

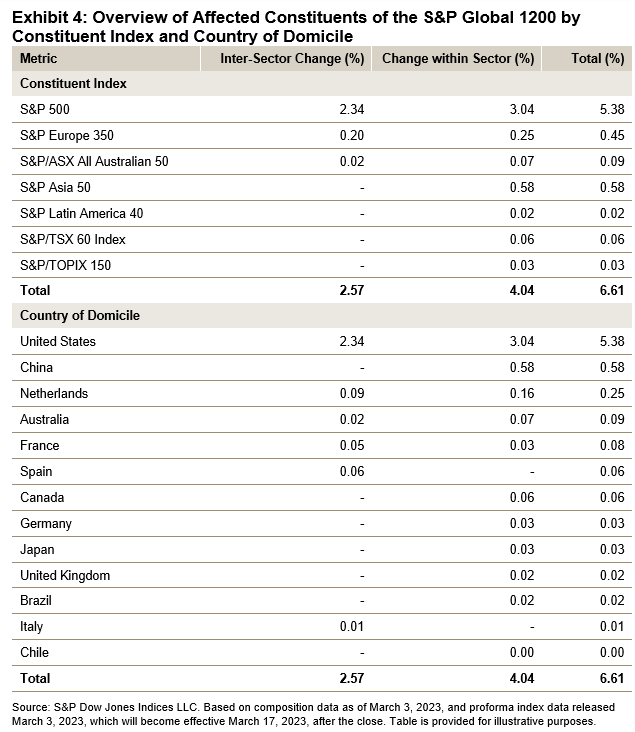

The latest rebalance for the S&P/TSX Composite Low Volatility Index, effective after market close on March 17, 2023, wrought minor shifts. Notably, the Materials sector made a reappearance after more than a year’s absence, holding 2% of the low volatility index. Financials added to its already dominant position (up 3%), which came mostly from Real Estate. The remaining sectors all experienced minor shuffles.