March 8th marks International Women’s Day, an event that honors and celebrates women worldwide and that has been observed for over a century. This year’s theme is Embracing Equity, and it highlights the fundamental difference between equality and equity. While these words are often used interchangeably, the former means giving everyone equal opportunities, while the latter recognizes specific circumstances when allocating resources to achieve equal outcomes. But how close are companies to attaining true gender parity?

The Road to Gender Balance

Not only is there an ethical case for gender parity, but also an economic one: enhanced female representation in the workplace could add USD 12 trillion to global GDP.1 Studies show the added benefits of corporate gender diversity, from entry-level to senior positions, leading to productivity and innovation gains.2 Regulation proposals aimed at increasing gender balance are growing, with the EU adopting minimum targets for corporate boards.3 Despite the progress, the road to gender balance is a long one—the World Economic Forum (WEF) estimates that it will take 132 years to close the gender gap.4

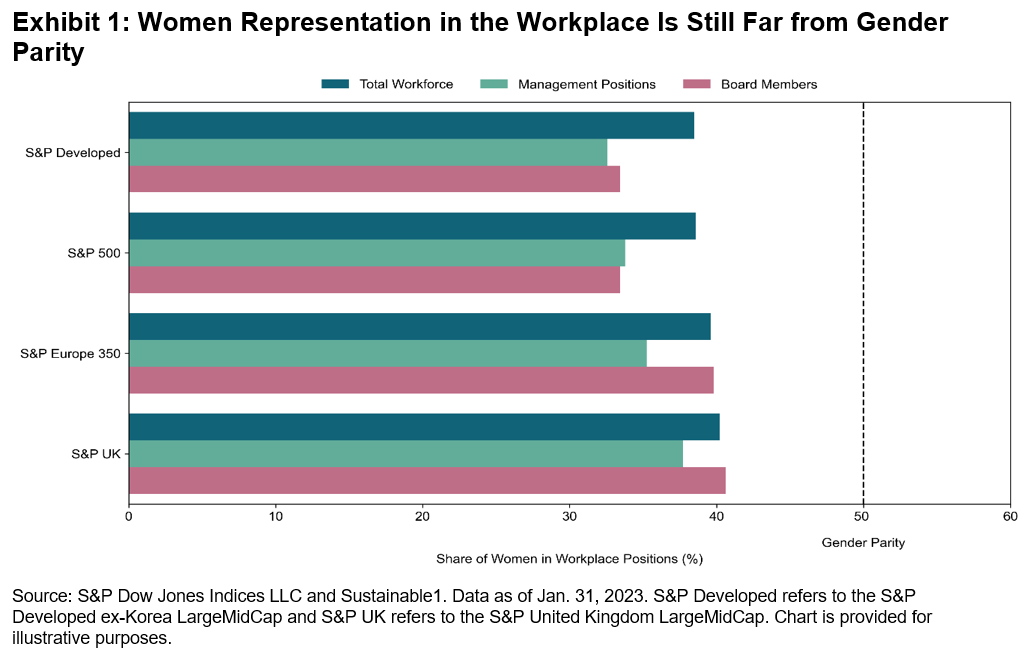

We explore the share of women in the workforce across regional indices, within management positions and at the board level, as well as the total number of women employed across all functions5 (see Exhibit 1). The U.K. is the only region where women cross the 40% threshold for board membership and across total workforce, with Europe and the U.S. closely following. Within the S&P 500®, women represent 39% of total workforce roles and close to 33% of board appointments.

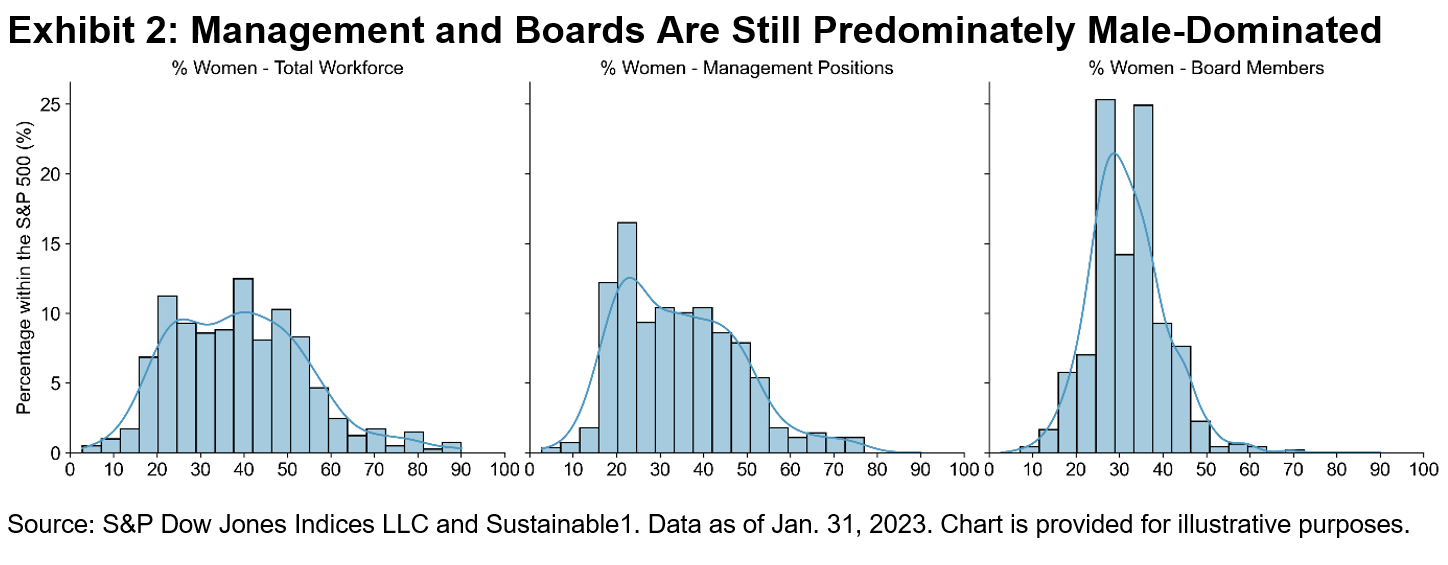

While weighted averages are helpful, they might not paint the full picture. We examine the distribution of female representation across three functions within the S&P 500. Management and board positions’ frequency distribution tends to be centered around lower percentages of women appointments (see Exhibit 2).

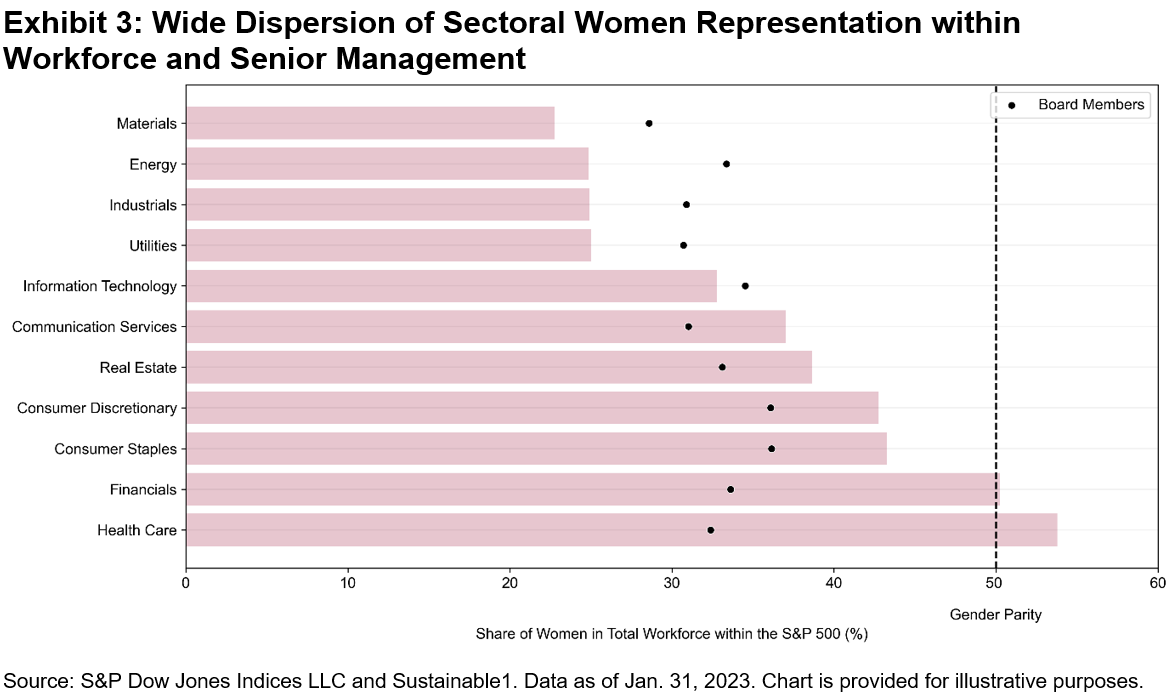

Looking at the S&P 500 from a sectoral perspective, Health Care and Financials lead the charts, with women representing at least 50% of total workforce, having reached gender parity (see Exhibit 3). Conversely, Materials and Energy are the least gender-diverse sectors. It is worth noting the sectoral dispersion between total workforce and boards’ women composition. The difference between most and least diverse sectors for board membership is 7.6%, while for total workforce is 31%.

Retaining Women Talent

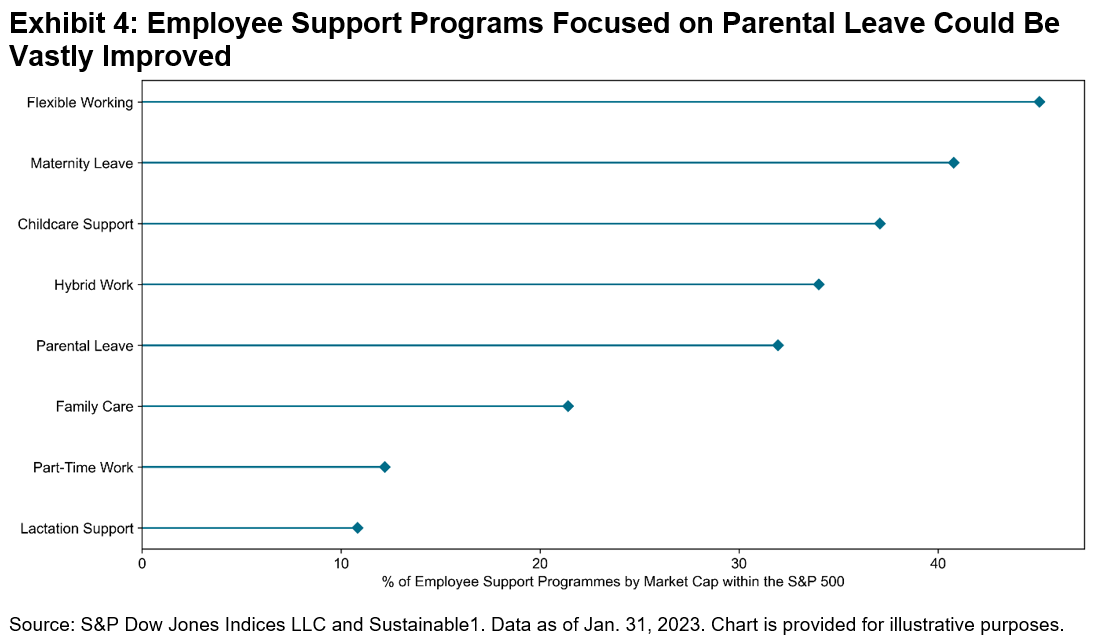

Not only are women still underrepresented across most corporate ladder levels, they are also leaving companies at an alarming rate relative to their male counterparts.6 Talent retention is increasingly important for women’s career advancement. Employee support programs, such as paid parental leave, flexible working and hybrid arrangements, can be highly beneficial. More than 45% of companies within the S&P 500 adopt flexible working and 40% have paid maternity leave (more than legally required), but only 32% offer paid non-primary parental leave (see Exhibit 4).

Going beyond equal opportunities and creating equal outcomes requires recognizing heterogeneity of women’s characteristics and circumstances, in order to remove systemic barriers that hinder long-term success. Data from the S&P Global Corporate Sustainability Assessment (CSA)7 suggests that workplace gender gaps persist across regions, sectors and managerial positions. There is more to do to bring and retain women in the workplace and empower them to attain their full potential. The benefits of doing so are vast and contribute to the UN’s Sustainable Development Goals’ agenda on Gender Equality.

1 McKinsey Global Institute gender report.

2 Harvard Business Review Research 2019.

3 European Commission announcement.

4 WEF Global Gender Gap Report 2022.

5 Management positions span junior, middle and senior management roles. Datapoints included in analysis have at least 80% coverage by weight.

6 Women in the Workplace Report 2022 within corporate America

7 More information on CSA here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.