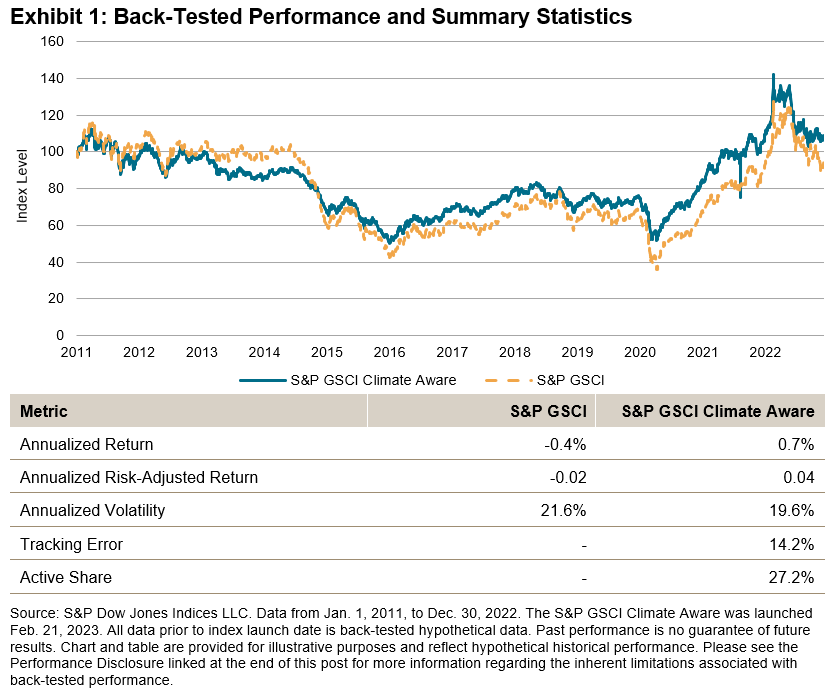

The S&P GSCI, the world’s leading commodities benchmark, could not escape the volatile markets experienced in February, as the index fell 3.83% for the month. Despite recent declines, inflation remained high, which kept the U.S. Fed steadfast in its rate-hiking campaign, and expectations for a possible easing by year-end 2023 were squashed in the latest Fed commentary. A strong retracement higher of the U.S. dollar from the weakness seen in January put pressure on all major commodities, which are priced in U.S. dollars globally.

Within the petroleum complex, S&P GSCI Heating Oil took the biggest hit, down 9.33% after a flat January. Warmer-than-expected weather in the U.S. played a role in decreasing demand for the crude oil byproduct. Crude oil supply was ample, with no change in OPEC’s production announced and record volumes of crude exports to China and India from Russia’s Pacific terminals. Russian crude exports to northern European countries ceased after EU sanctions took effect on Feb. 5.

The S&P GSCI Industrial Metals fell 7.82% in February with broad weakness across all metals. Despite China’s easing of COVID-19 restrictions, demand from the world’s leading importer of industrial metals has not recovered yet. China’s latest forward-looking Manufacturing PMI reading showed the fastest growth in a decade, however. The S&P GSCI Nickel fell the most among the industrial metals, down 18.27%. The International Nickel Study Group announced that in 2022, the global nickel market flipped from a deficit to a surplus for one of the key metallic inputs to electric vehicles. The London Metal Exchange’s nickel contract is still in question after last year’s spike in prices, leading other exchanges like the CME to announce in February that they would launch an alternative nickel contract by the end of March.

The S&P GSCI Gold gave back all of its gains from January, ending February with a flat YTD performance. The S&P GSCI Silver fell 12.06% in sympathy with gold. Silver prices tend to be much more volatile than gold, to the downside as well as the upside. The pressure from the industrial metals space was also felt with silver’s global demand making up about 50% of its use.

Within agriculture, S&P GSCI Wheat prices fell the most, down 8.20% YTD. According to S&P Global Commodities Insights, global wheat prices are expected to see further declines due to the likely rise in supplies across producer countries such as Australia, Canada and Russia. After a year of tightened supplies from the start of the Russia-Ukraine conflict, supplies are likely to normalize.

The S&P GSCI Livestock rose 1.29% and was the only sector to end the month in positive territory, with feeder cattle and live cattle leading the way. Cattle prices have risen steadily since their low in May 2022 due to a progressively smaller global herd and global demand remaining strong.

The posts on this blog are opinions, not advice. Please read our Disclaimers.