How can index construction inform style selection? S&P DJI’s Craig Lazzara takes a closer look at the S&P Style and S&P Pure Style Indices and how these different approaches to indexing Growth and Value are designed to help advisors align strategies with client objectives.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Surveying Style Indices

The S&P China 500 Rebounded 7.1% in Q4 2022, Recovering a Portion of Its 2022 Losses

Building a Passive Bridge across the Pond

Examining a Broad-Based Approach to ESG

The Dow Jones Dividend 100 Indices Part 2: Strong Fundamentals and the Benefits of Diversification

Surveying Style Indices

- Categories Equities, Factors

- Tags 2023, Craig Lazzara, equities, factors, Financial Advisors, growth investing, growth vs. value, indexing, pure growth, pure style, pure value, S&P 500 Growth, S&P 500 Pure Growth, S&P 500 Pure Value, S&P 500 Value, S&P Pure Style, S&P Pure Style Indices, S&P Style, Style, style bias, U.S. style, US FA, value investing

The S&P China 500 Rebounded 7.1% in Q4 2022, Recovering a Portion of Its 2022 Losses

The S&P China 500 gained 7.1% in Q4 2022, gaining back some of the losses exhibited earlier in 2022. Despite the strong quarter, Chinese equities underperformed global and emerging markets in Q4, as these segments broadly bounced back from the heavy losses of Q3. The S&P China 500 declined 24.4% in 2022, likewise underperforming global and emerging market indices. For the final quarter of 2022, Communication Services, Health Care and Financials sectors led the gains, all up over 10%.

The S&P China 500 underperformed other Asian markets, which in some cases posted strong gains during Q4. Notable outperforming benchmarks were the S&P Hong Kong BMI, S&P Korea BMI and S&P Japan BMI, which returned 18.8%, 18.2% and 12.9%, respectively. Meanwhile, the S&P Indonesia BMI dropped nearly 9% during Q4 after being the sole positive performer in the region during Q3.

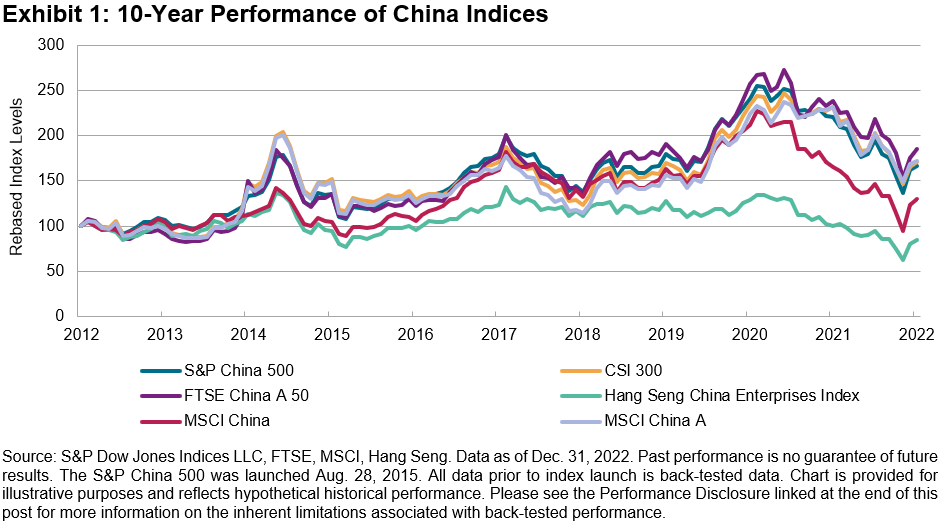

The S&P China 500 continues to maintain positive performance over the long term. With an annualized gain of 5.2% in USD over the past 10 years, the index has easily outperformed the S&P Emerging BMI, which had an annualized gain of only 2.6% over the same period.

Offshore Stocks Outperformed Onshore

Both domestic and offshore listed China equities delivered positive returns during the quarter. The global downturn in equities this year has resulted in higher correlation in China equity share types, however Q4 2022 saw offshore China listings significantly outperform their onshore counterparts. Given its diversified composition across Chinese share classes, the S&P China 500 outperformed the indices that had more weight in China A-shares and underperformed those with more exposure to Hong Kong-listed Chinese companies (see Exhibit 1).

Communication Services and Health Care Led the Gains

Communication Services and Health Care Led the Gains

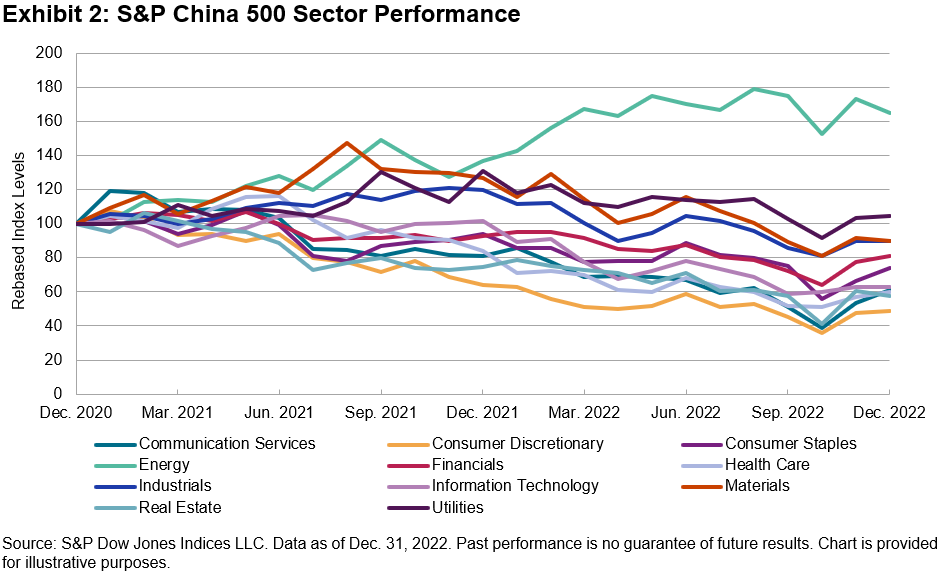

Communication Services and Health Care outperformed in Q4, gaining 19.5% and 16.2%, respectively. Financials also had a strong quarter, up 12.4%. Consumer Staples was the largest drag on the S&P China 500’s performance, as it declined 1.6%. The Energy sector also saw negative returns during the quarter.

At the company level, the major contributors to the index’s performance during the quarter were Tencent, which clawed back all its previous quarters losses to post 26.1%; Alibaba, which was up over 10%; and Pinduoduo, which also had a strong quarter. In terms of outright performers, Shanghai Junshi Biosciences gained 95.5% on the back of a positive result from a clinical trial of a lung cancer treatment, while Country Garden Services regained Q3 losses and more—rising 69.1%—and Sinotruk, a heavy-duty vehicle manufacturer, also gained 66.6%.

NIO Inc (down 38.2%), Kweichow Moutai (down 5.9%) and LONGi Green Energy Technology (whose share price declined just over 10%) were among the few noteworthy detractors to the index’s performance during the quarter.

Valuation Metrics Remain Attractive

Valuation Metrics Remain Attractive

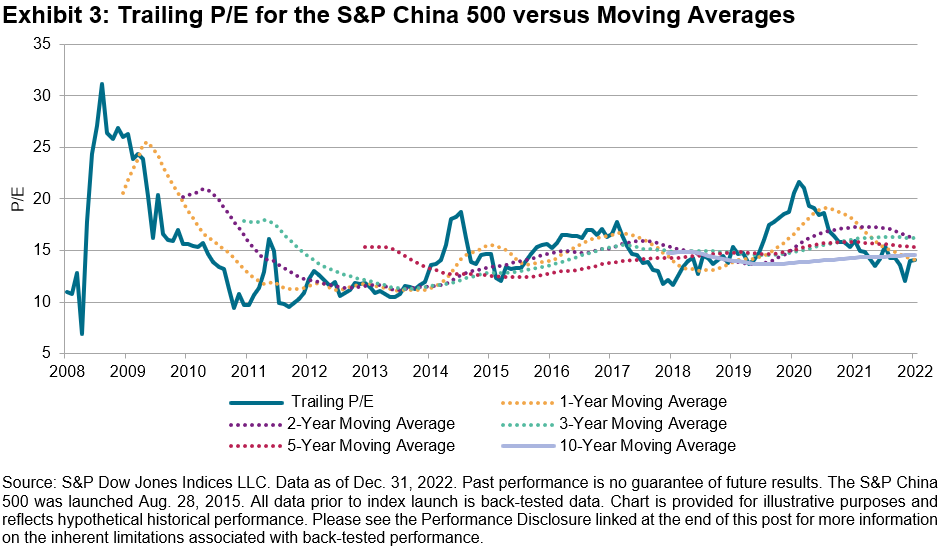

The S&P China 500 trailing P/E increased to 14.1x in Q4 (13.6x the prior quarter), however it remained below the 3-, 5- and 10-year averages. The rolling 1-, 3-, and 5-year P/E ratios remained slightly above the long-term average.

The trailing P/E for the S&P Emerging BMI also increased to 13.2x, as security price gains were broad across ex-China emerging regions. The S&P China 500 index dividend yield, meanwhile, decreased from 2.58% to 2.44% on a quarterly basis.

The trailing P/E for the S&P Emerging BMI also increased to 13.2x, as security price gains were broad across ex-China emerging regions. The S&P China 500 index dividend yield, meanwhile, decreased from 2.58% to 2.44% on a quarterly basis.

Building a Passive Bridge across the Pond

At over 300 years old, the British government bond and stock markets are among the world’s oldest. They are also among the largest globally; ranked by float-adjusted market capitalization, the U.K. gilt market and U.K. stock market are the fourth and third biggest, respectively. The British investment industry has existed for centuries, with the country’s (and world’s) oldest collective investment scheme launched over 150 years ago. Despite this long history, U.K. investment funds have been just as likely to suffer from home country bias as their international peers.

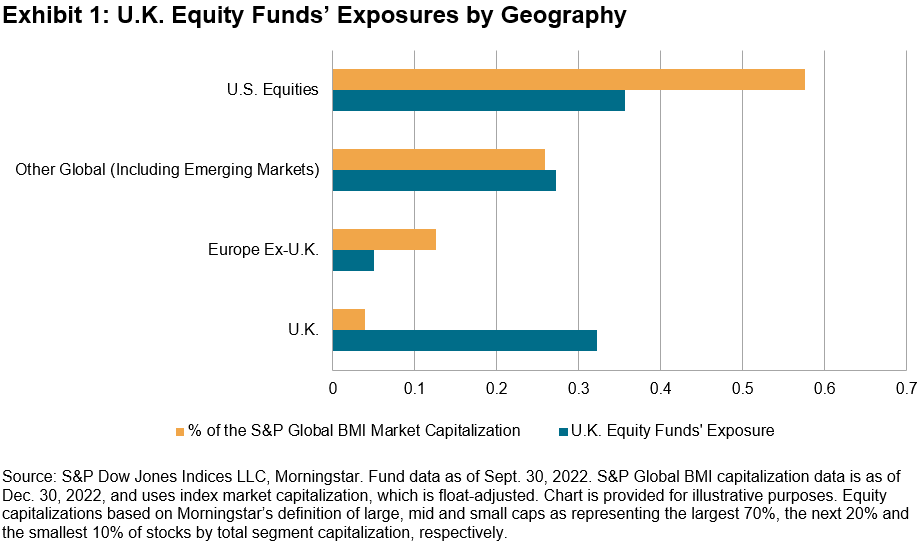

Exhibit 1 shows that U.K.-domiciled equity funds are substantially overweight their home market and underweight elsewhere, with the largest underweight in the U.S. By investing a disproportionate fraction of their assets in companies and industries based in their home country rather than globally, British market participants may be missing out on diversification benefits and potentially higher returns.

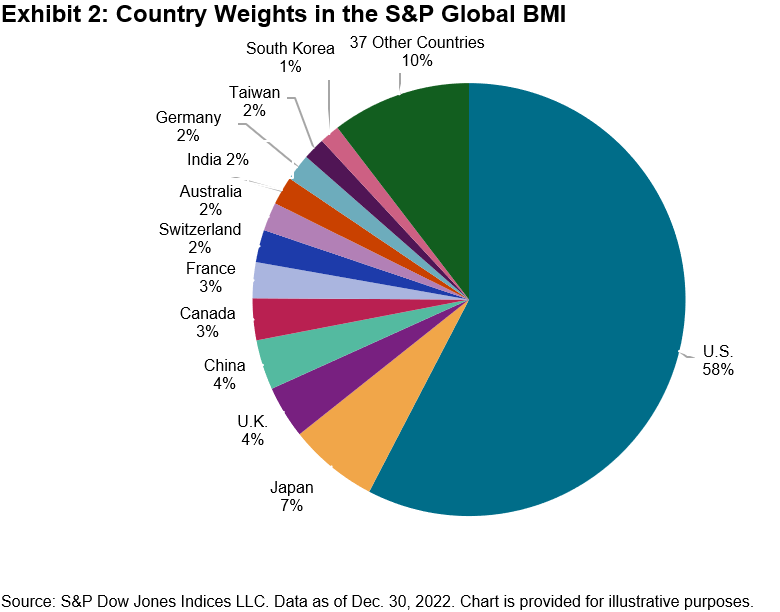

There is a large global opportunity set available to British investors, ranging across countries, sectors and currencies, and including large global companies without British equivalents. There were approximately 41,000 listed companies in the world at the end of 2019. Eliminating the smallest and least liquid names leaves around 14,000 companies from 25 developed and 24 emerging markets; Exhibit 2 shows how these compose the S&P Global BMI. With an aggregate free-float market capitalization of USD 66 trillion, the index is designed to reflect the global investable opportunity set. Given its 58% weight in the S&P Global BMI, for many investors the U.S. market represents the natural first step to globalizing their exposures.

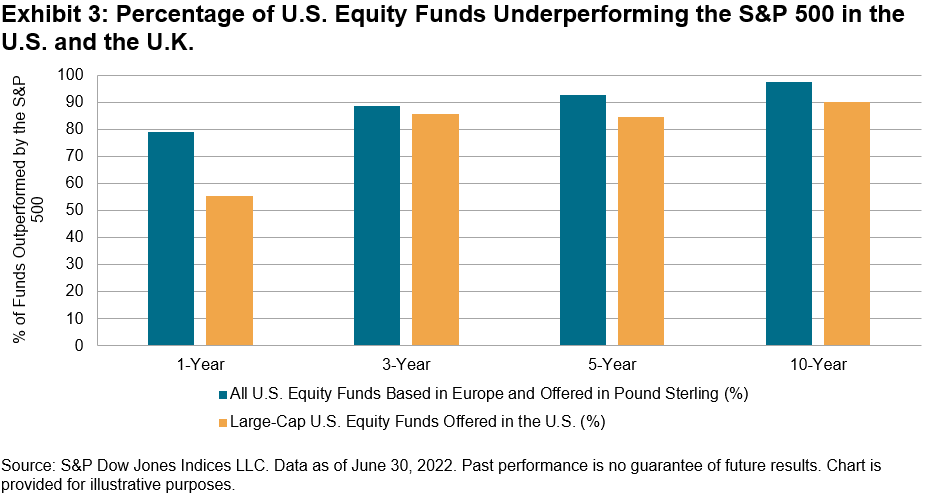

When considering an allocation to any market segment, including U.S. equities, investors must choose between active security selection and tracking a broad-based market portfolio. The SPIVA Europe Mid-Year 2022 and SPIVA U.S. Mid-Year 2022 Scorecards can help inform this decision. The historical data summarized in Exhibit 3 suggest that outperformance in large-cap U.S. equities is uncommon for fund managers based in either market, with outperformance even more elusive for longer time horizons.

These results are unsurprising. Simple arithmetic indicates that the average market participant earns the market return before fees and costs. Professional fund managers might expect to outperform in a market dominated by small retail traders, over whom they arguably have an informational and operational edge. But in markets dominated by large institutional and professional investors—as large-cap U.S. equities have been for at least 50 years—consistent outperformance becomes less likely, making the case for passive management stronger.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Examining a Broad-Based Approach to ESG

- Categories ESG

- Tags Broad Market ESG, core ESG, ESG, ESG data, ESG scores, Financial Advisors, indexing, Maggie Dorn, S&P 400 ESG, S&P 500 ESG Index, S&P 600 ESG, S&P Global Corporate Sustainability Assessment, S&P Global CSA, S&P MidCap 400 ESG, S&P SmallCap 600 ESG, sustainability, US FA, Wealth Managers

Take a closer look at the index design and data powering S&P DJI’s headline ESG indices with Maggie Dorn and DWS’ Taylor Anderson.

The posts on this blog are opinions, not advice. Please read our Disclaimers.The Dow Jones Dividend 100 Indices Part 2: Strong Fundamentals and the Benefits of Diversification

In part one of this series, we highlighted how the stringent dividend sustainability and quality screens of the Dow Jones U.S. Dividend 100 Index and Dow Jones International Dividend 100 Index may have led to their outperformance in 2022 and other inflationary periods.

In this installment, we will analyze the positive effects that these screens had on the fundamentals of both indices, as well as examine examples of combining the U.S. and international indices to harness possible diversification benefits.

Comparing Fundamentals

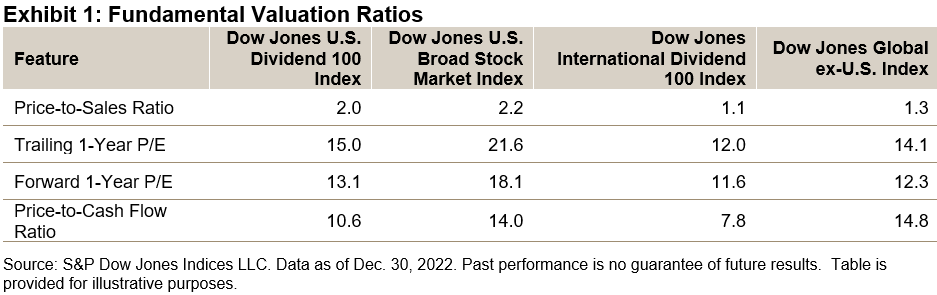

Exhibits 1, 2 and 3 show the significantly improved value and quality metrics that both Dow Jones 100 Indices had compared with their respective benchmarks. Exhibit 1 shows that both Dow Jones Dividend 100 Indices traded at a discount to their respective benchmarks on every valuation metric. A value tilt may prove important in a rising interest rate environment, because value stocks tend to receive larger cash flows in the near term, and therefore typically have lower durations relative to growth stocks. Holding all else equal, value stocks may perform better in a rising interest rate environment compared with growth stocks.1

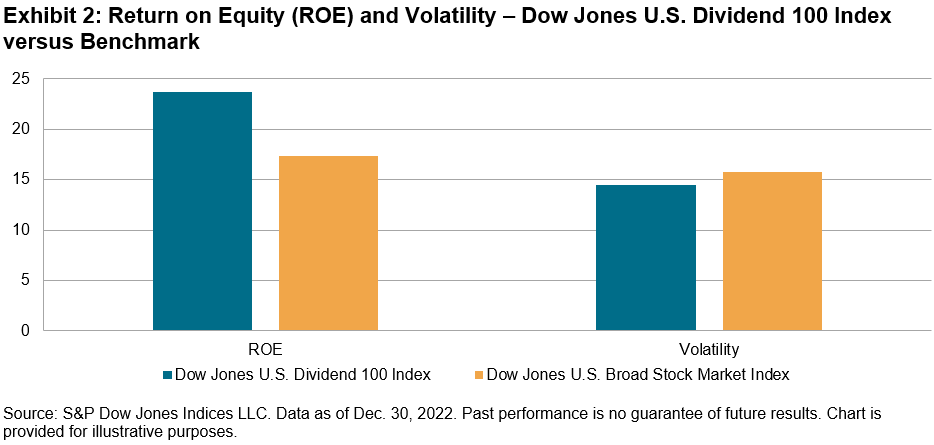

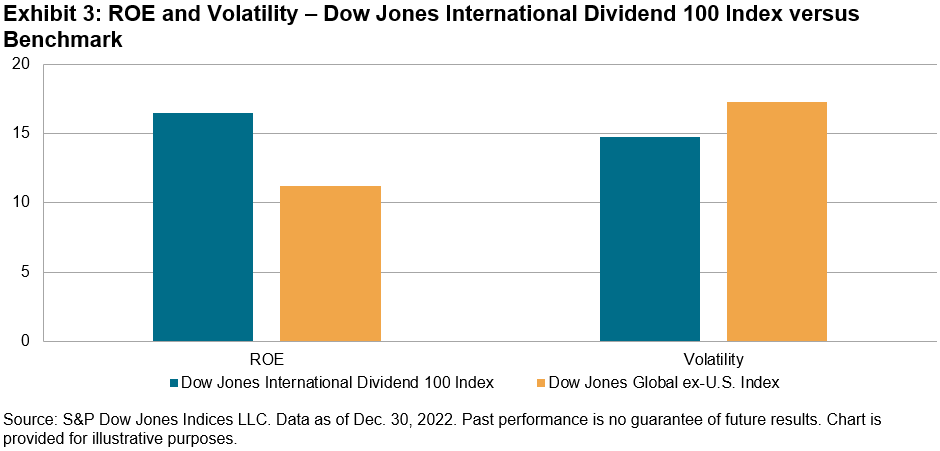

Furthermore, as Exhibits 2 and 3 show, both Dow Jones Dividend 100 Indices held a quality advantage and volatility reduction compared with their respective benchmarks. These features may have proved particularly beneficial amid 2022’s rapidly rising interest rates and deteriorating economic environment.

Potential Diversification Benefits

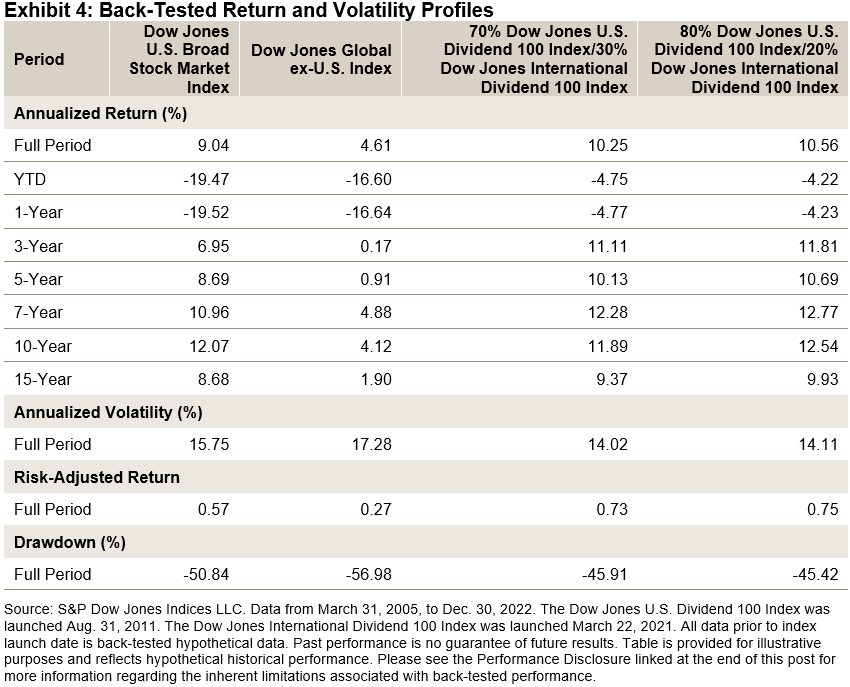

An interesting option for those wanting to reduce volatility while potentially enhancing dividend yield is to pair the Dow Jones International Dividend 100 Index with the Dow Jones U.S. Dividend 100 Index. Exhibit 4 illustrates two hypothetical weighting scenarios and their simulated performance. The first scenario allocates 70% weight to the U.S. index and 30% to the international index, while the second scenario allocates 80% weight to the U.S. index and 20% to the international index.

When observing the back-tested period of this hypothetical combined index starting in March 2005, the 70%/30% scenario had a full period of annualized 10.25% performance, exceeding both benchmarks, with volatility reduced to 14.02%. In the 80%/20% scenario, the annualized performance was to 10.56%, while the volatility was 14.11%. the back-tested hypothetical risk-adjusted return and maximum drawdown were significantly improved versus both benchmarks.

Conclusion

As discussed in part one, the Dow Jones U.S. Dividend 100 Index and Dow Jones International Dividend 100 Index performed well versus their benchmarks in 2022, despite a difficult economic environment. This may in part be due to their higher yields and fundamentals relative to their benchmarks.

For institutions only, not for retail investors.

l https://www.institutionalinvestor.com/article/b1wd19khdzwj89/In-an-Inflationary-Environment-Value-Stocks-Offer-a-Refuge

The posts on this blog are opinions, not advice. Please read our Disclaimers.