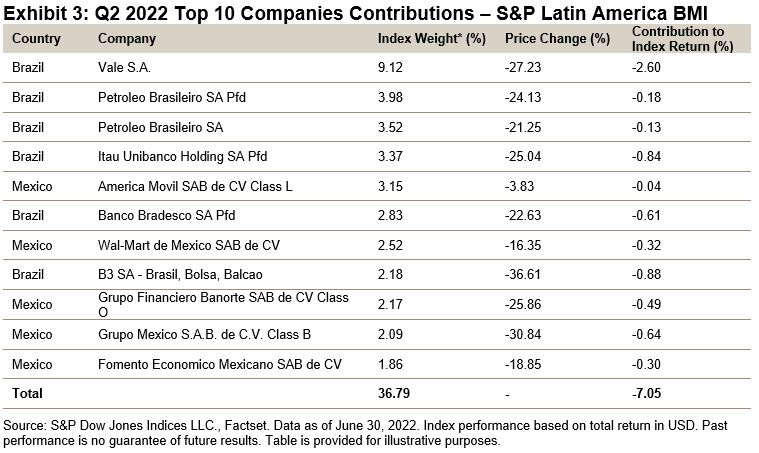

After last week’s highest inflation print in over four decades, the U.S. dollar (USD) rose to its strongest level in 20 years, as measured against a broad basket of currencies. The euro also hit parity with the USD for the first time since 2002 as a consequence of Europe’s front-line exposure to the Russia-Ukraine conflict and the perception that the European Central Bank has been slow to raise interest rates. Most major commodities included in the headline commodity benchmark, the S&P GSCI, are still showing positive gains YTD, even with the global recession fears permeating market sentiment. Some traditional inflation hedging assets are not performing as expected, with negative YTD performance for real estate, gold, and U.S. Treasury Inflation Protected Securities (TIPS) (see Exhibit 1), but commodities have recently been offering inflation protection amicably.

Commodities’ outperformance can be explained by the energy sector commodities. The worst-performing energy constituent within the S&P GSCI, S&P GSCI Crude Oil, was up 41.36% YTD. While gasoline prices have been getting the headlines in the U.S., gasoil, heating oil and natural gas were all up nearly 100% in 2022. A cooling off of these energy commodities could be a leading indication for cooling of inflation in the near term.

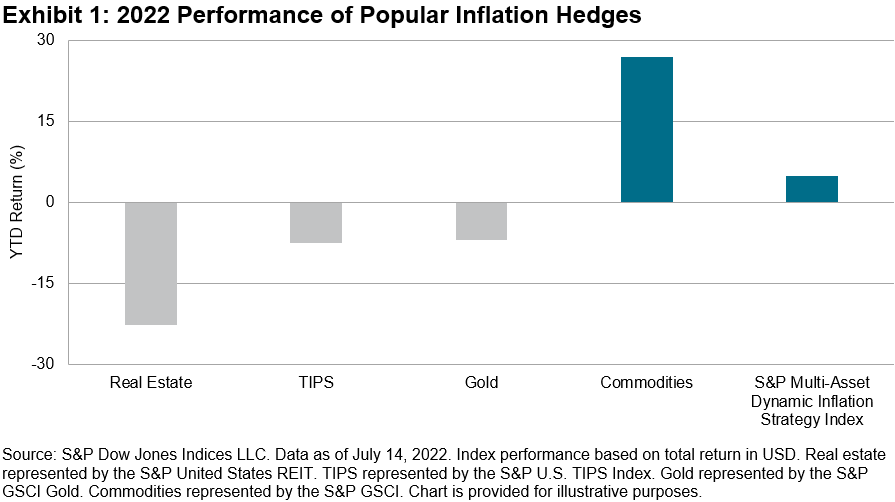

USD strength has traditionally been a headwind for commodities. Most major commodities around the world are priced in USD, so when the currency strengthens, buying commodities becomes more expensive in non-USD currencies. As one strengthens, the other weakens. But this has not been the case recently, and there are previous periods in history where this relationship has faltered (see Exhibit 2). In this case, commodities moved first, and the USD strength has been more recent in response to an abrupt switch in global monetary policy aimed at cooling inflation. Something will have to give soon if this unusual situation based on history continues in the short run. If inflation finally starts to ease, it’s possible the U.S. Federal Reserve might ease up on its rate hiking regime, thereby cooling off the red-hot USD.

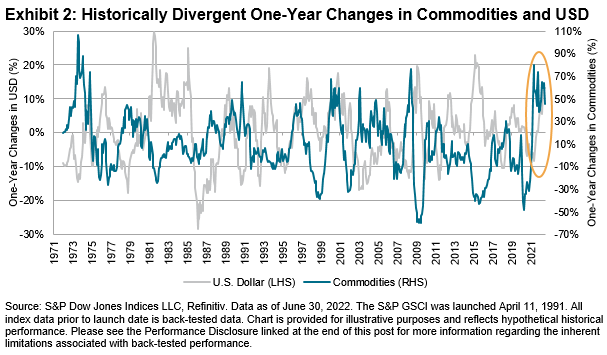

Where does this leave us in the current environment compared to similar situations historically? During two similar periods where skyrocketing inflation was met with interest rate tightening (in the 1980s and 2000s), commodities still tended to outperform, although eventually the high cost of goods caused the U.S. consumer to suffer and recessions to ensue. Commodities have posted double-digit percentage gains during high inflationary regimes, as can be seen in Exhibit 3. Allocating aggressively to commodities and away from equities during these times has tended to produce favorable risk-adjusted returns, as can be seen by our S&P Multi-Asset Dynamic Inflation Strategy Index, with a 6.4% gain YTD. For more information on this index, please read our prior blog.

Where does this leave us in the current environment compared to similar situations historically? During two similar periods where skyrocketing inflation was met with interest rate tightening (in the 1980s and 2000s), commodities still tended to outperform, although eventually the high cost of goods caused the U.S. consumer to suffer and recessions to ensue. Commodities have posted double-digit percentage gains during high inflationary regimes, as can be seen in Exhibit 3. Allocating aggressively to commodities and away from equities during these times has tended to produce favorable risk-adjusted returns, as can be seen by our S&P Multi-Asset Dynamic Inflation Strategy Index, with a 6.4% gain YTD. For more information on this index, please read our prior blog.

Commodities have been known as an inflation hedging asset mostly because they are raw materials that go into the production of the goods that tend to rise in lockstep with inflation. Much of the recent strength in commodities prices can be attributed to supply shocks, including the Russia-Ukraine conflict and post-COVID-19 supply chain disruptions. Longer term, there are additional supply constraints imposed by the energy transition. Interest rates are a blunt monetary instrument and can do little to directly address these supply constraints, but they can slow demand. Similarly, USD strength may eventually hamper commodity demand from non-U.S. consumers.

The posts on this blog are opinions, not advice. Please read our Disclaimers.