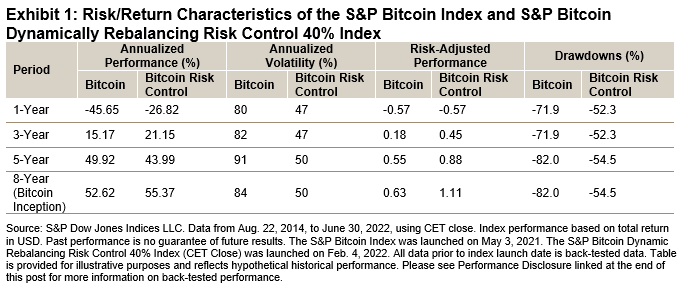

Earlier this year, we reported on the volatility of Bitcoin and cryptocurrencies overall. In February 2022, the market was slightly down from its all-time high in November 2021. S&P Dow Jones Indices had just launched the new S&P Bitcoin and Ethereum Dynamically Rebalancing Risk Control 40% Indices (CET Close), and we saw that risk-adjusted performance over time of the Bitcoin risk control index exceeded that of the underlying S&P Bitcoin Index.

Since then, the crypto market has experienced a significant downturn, while equities officially entered a bear market. For crypto, the collapse of Terra and its sister coin Luna,1 the halt of withdrawals from the Celsius network2 and the contagion to other firms such as crypto hedge fund Three Arrows Capital and crypto lender Babel3 created difficult conditions in the second half of the Q2.

Why not review how the crypto risk control indices performed through this time period and see how they met the index methodology goals of mitigating volatility?

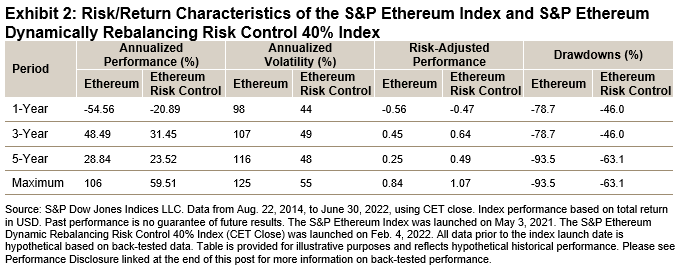

Exhibits 1 and 2 show the performance for the S&P Bitcoin and S&P Ethereum Dynamically Rebalancing Risk Control 40% Indices and their underlying benchmark indices.

Specifically, for the Bitcoin risk control index, during the June market drop, the rebalance was triggered three times. The rebalance adjusts the exposure to the underlying index and allocates to U.S. dollars on any given day when the 10% threshold based on exposure is crossed. While the benchmark S&P Bitcoin Index was down 40% in June, the S&P Bitcoin Dynamically Rebalancing Risk Control 40% Index was down just 21%. This demonstrates how responsive the dynamic nature of the risk control index is to the current market conditions, and the methodology mitigated the effects of volatile, declining markets.

However, not all is gloom and doom in the crypto space. It is worth noting that the S&P Bitcoin Index was up 15% in the first week of July (as of July 7, 2022), and the S&P Bitcoin Dynamically Rebalancing Risk Control 40% Index was up 4% during this period. As expected with this asset class, volatility continues, and risk control can help mitigate it.

For additional details, please refer to the S&P Risk Control Indices Methodology & Parameters for current parameters and to the S&P Risk Control Indices section of the S&P DJI Index Mathematics Methodology.

For S&P DJI, this is another innovative way to bring tools and transparency to this emerging asset class.

3 https://www.coindesk.com/layer2/2022/06/29/why-the-crypto-unwind-wasnt-contagious-this-time/; https://www.coindesk.com/business/2022/07/01/troubled-crypto-lender-babel-finance-looking-to-hire-restructuring-specialist-houlihan-lokey-sources/

The posts on this blog are opinions, not advice. Please read our Disclaimers.

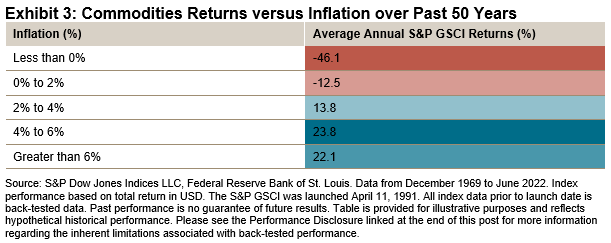

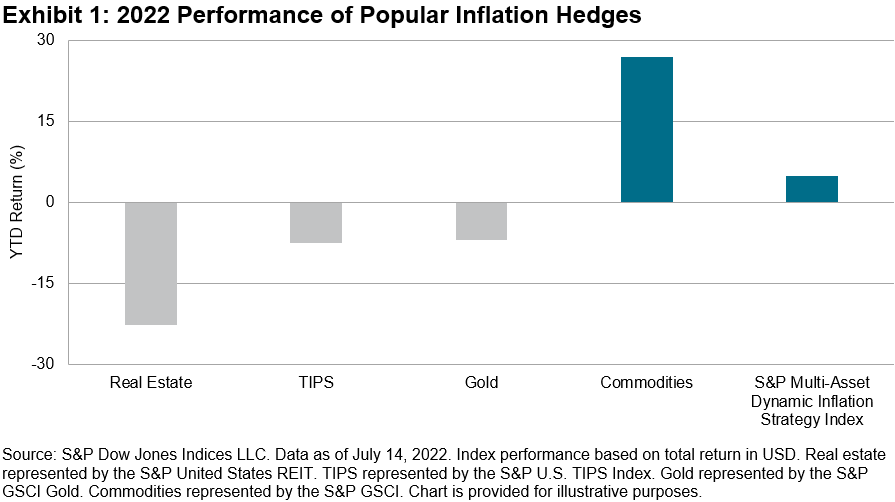

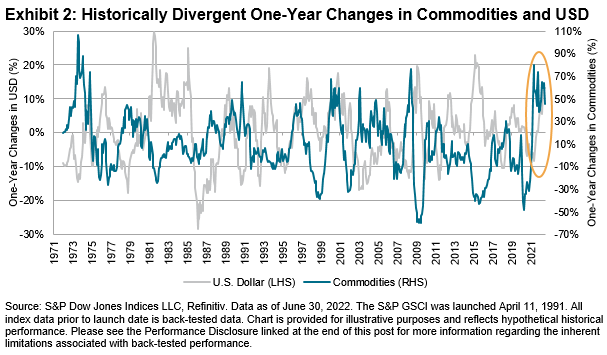

Where does this leave us in the current environment compared to similar situations historically? During two similar periods where skyrocketing inflation was met with interest rate tightening (in the 1980s and 2000s), commodities still tended to outperform, although eventually the high cost of goods caused the U.S. consumer to suffer and recessions to ensue. Commodities have posted double-digit percentage gains during high inflationary regimes, as can be seen in Exhibit 3. Allocating aggressively to commodities and away from equities during these times has tended to produce favorable risk-adjusted returns, as can be seen by our

Where does this leave us in the current environment compared to similar situations historically? During two similar periods where skyrocketing inflation was met with interest rate tightening (in the 1980s and 2000s), commodities still tended to outperform, although eventually the high cost of goods caused the U.S. consumer to suffer and recessions to ensue. Commodities have posted double-digit percentage gains during high inflationary regimes, as can be seen in Exhibit 3. Allocating aggressively to commodities and away from equities during these times has tended to produce favorable risk-adjusted returns, as can be seen by our