Recently announced results for a consultation on the S&P PACT™ Indices (S&P Paris-Aligned & Climate Transition Indices) reveal that they will now target country and sector neutrality. This has the potential benefit of comparing companies, as much as possible, to close peers (those in the same sector and country), while reducing active risk.

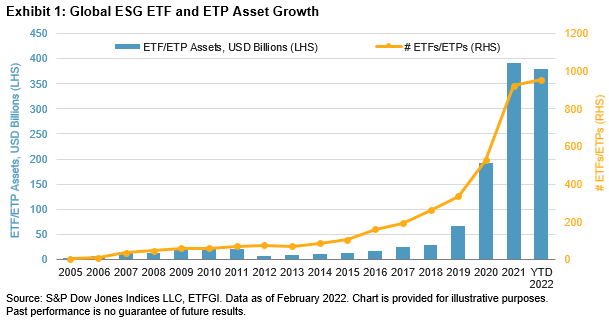

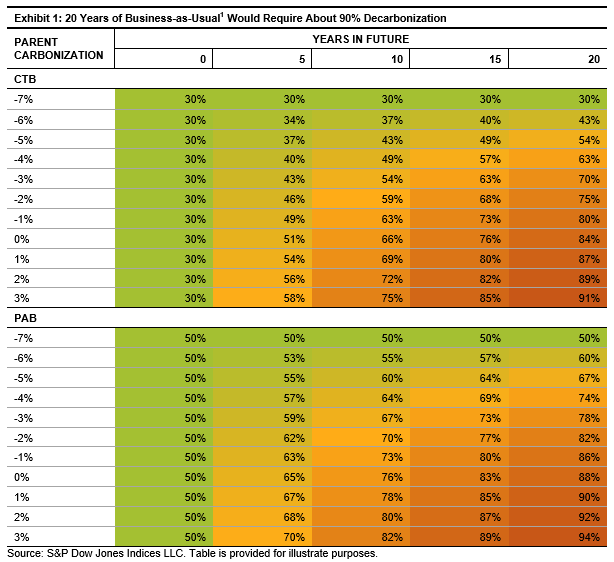

The EU’s minimum requirements for Climate Transition and Paris-aligned Benchmarks (CTB and PAB, respectively) represent a new paradigm within climate investing—an absolute decarbonization pathway, meaning that strategies may have to achieve significantly higher levels of decarbonization relative to a benchmark in the future than they do today, if the benchmark does not significantly decarbonize (see Exhibit 1).

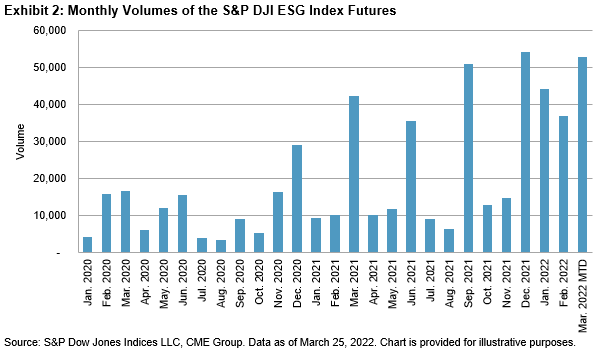

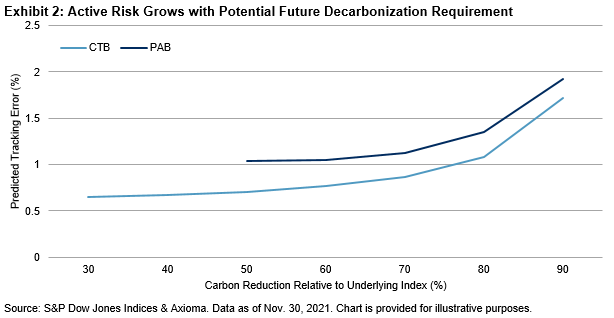

Given we do not know whether the world will decarbonize, we stress tested the methodology to understand, even when getting to a 90% decarbonization relative to the underlying universe, whether the S&P PACT Indices can meet the index objective. We see the index methodology finds a solution, becoming more active as the decarbonization grows, as expected, but remaining relatively benchmark like (see Exhibit 2).2

As we don’t know how much of a relative decarbonization we will need in the future, we can’t know how active the index will need to be. So, what’s the best way to address sector and country active risk that can continue to work throughout time?

A constraint on sector allocation may yield suboptimal outcomes. If we were to implement a tight sector constraint that worked well at inception (30% decarbonization), this may result in extreme stock-specific risk to maintain sector neutrality at greater levels of decarbonization, which may potentially be required in the future—e.g., sector constraints could be met by allocating all of the weight of one sector to one or two stocks with the lowest carbon intensity, causing concentration risk. Alternatively, we could take a more relaxed approach and set a sector constraint that would work well at a closer to 80% decarbonization, which would likely take on significantly more active sector risk than required to meet the ESG and climate objectives.

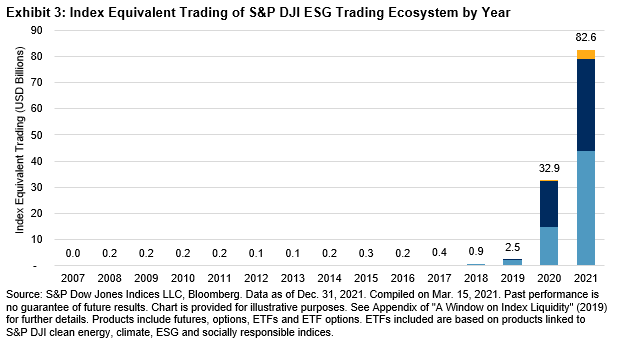

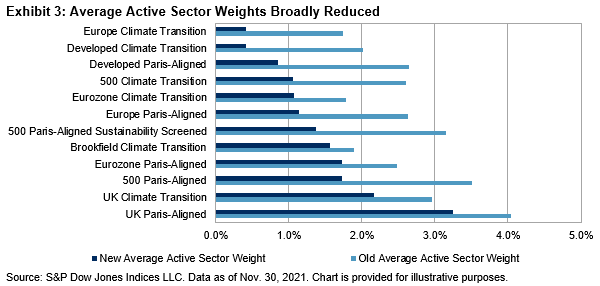

A more flexible solution might be to incorporate active sector weight penalization within the objective function, to produce an optimal balance among stock-specific active risk, country active risk and sector active risk—the change we will see in the upcoming rebalance, based on the recent consultation. This new objective function allows for a broad reduction in active sector weight across indices (see Exhibit 3) and potential levels of decarbonization required.

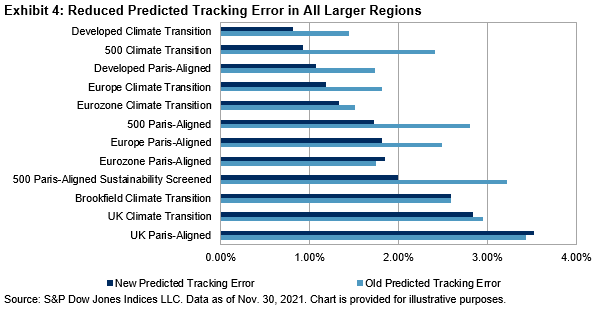

How do these reduced sector and country active risks, alongside other methodology changes, translate into predicted tracking error? We see large reductions within the largest regional indices, for both the climate transition and Paris-aligned variants (see Exhibit 4).

Impact analysis reveals changes to the S&P PACT Indices via this consultation would have caused companies to be compared more with their direct country and sector peers and reduced tracking error, while still meeting all the climate objectives, within a glass-box optimization framework. This allows for a sophisticated, multifaceted ESG and climate index and has historically provided benchmark-like characteristics.

1 For frame of reference, between 1950 and 2019, the global CO2 emissions grew by 2.66% (Our World in Data, 2022).

2 Note that this stress test is based on a hypothetical index based on the S&P Developed ex-U.S. universe. This stress test assumes that only the decarbonization rate required will change over time.

The posts on this blog are opinions, not advice. Please read our Disclaimers.