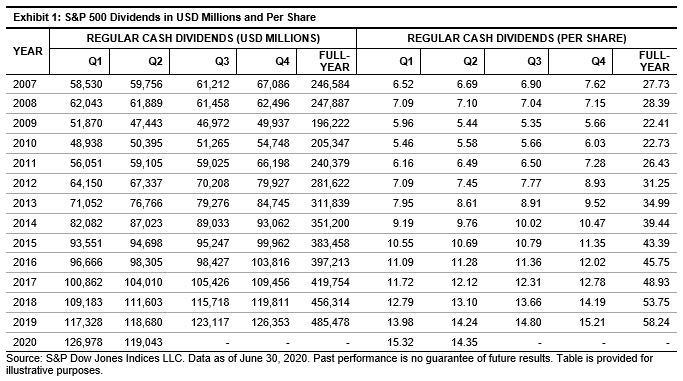

Back in mid-February 2020, S&P 500 issues were easily on track to set their ninth annual record for dividend cash payments, as forecasts called for double-digit 2020 returns. By month-end February, 113 issues in the S&P 500, 22% of the index, had increased their dividends, with no cuts (and certainly no suspensions), and Q1 2020 went on to return a record USD 127 billion of cash payments to holders.

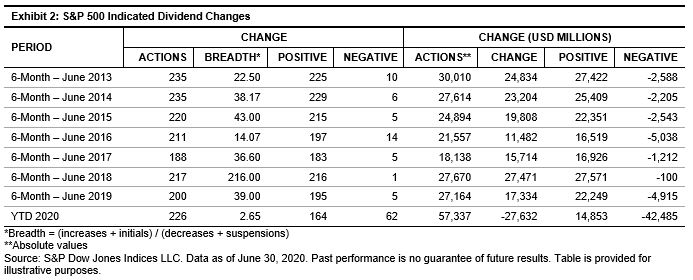

All was good until the word “corona” turned from a beer order into a virus. By the end of June, four months later, the index posted 49 additional increases (with lower increases; the Q2 2020 average increase was 7.50% versus Q1 2020’s 9.01% and Q2 2019’s 11.03%), along with 62 decreases, with 41 of the 62 being suspensions (the last suspension was in 2017 by PG&E). Still, the Q2 2020 payments held up, as companies fulfilled their prior declarations, returning USD 119 billion to holders. The amount was higher on a year-over-year basis (0.3% over Q2 2019), but 6.2% lower than the record Q1 2020 payment. Because of the record Q1 2020 payment, the payment for the first half of 2020 was 5.1% higher on a year-over-year basis.

However, the announcements of Q2 2020 payments that started in March paint a different picture of the second half of 2020. The first half produced USD 14.9 billion in announced increases and USD 42.5 billion in cuts, resulting in a USD 27.6 billion reduction in dividends, with the immediate result of lower declared payments for Q3 and Q4 2020.

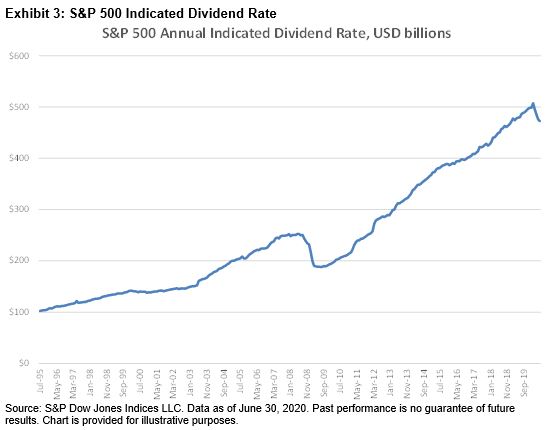

If one thinks of dividends as a paycheck, a 25-year wage growth, compounded using actual cash payments, amounts to 6.4% annualized. The annualized growth from the full recovery from the financial downturn to YTD was higher, at 7.6%. From February 2020, when dividend rates reached an all time high, to now, the drop was equivalent to taking a 6.8% pay cut.

At the moment, the 2020 estimate for payments from S&P 500 issues has improved to a 2% decline in the actual 2020 payment over 2019, compared with May’s decline estimate of a 3%-4% decline. The last down dividend year for the index was in 2009 (-21.07%).

Taken all together, the swift dividend cuts and suspensions have overpowered smaller and fewer increases for S&P 500 companies. Going forward, if the reopening continues to be positive for the economy, the major damage of cuts and suspensions could be behind us. It is worth noting that while the current working estimate for S&P 500 issues has improved, it remains contingent on the reopening.

The posts on this blog are opinions, not advice. Please read our Disclaimers.