As the world continues to pump the gas on a one-way street toward catastrophic climate change, market actors are attempting to slow down the traffic by limiting global temperature rise to within 1.5°C since pre-industrial levels.[1] To date, climate-conscious investors have largely focused on reducing relative portfolio carbon exposure. However, divergent methodologies make fertile ground for greenwashing, while point-in-time analyses do not necessarily inform alignment with the low-carbon transition. To address this, the EU is proposing regulation to prevent climate index greenwashing.[2] Global efforts such as the G20’s Task Force for Climate-related Financial Disclosures (TCFD) also seek to enhance transparency with guidance for holistic climate disclosure. A new S&P Paris-Aligned Climate (PAC) Index Concept now offers a powerful tool to address the minimum EU standards for a Paris-aligned benchmark and the recommendations of the TCFD.

Minimum Standards for EU Climate Benchmarks

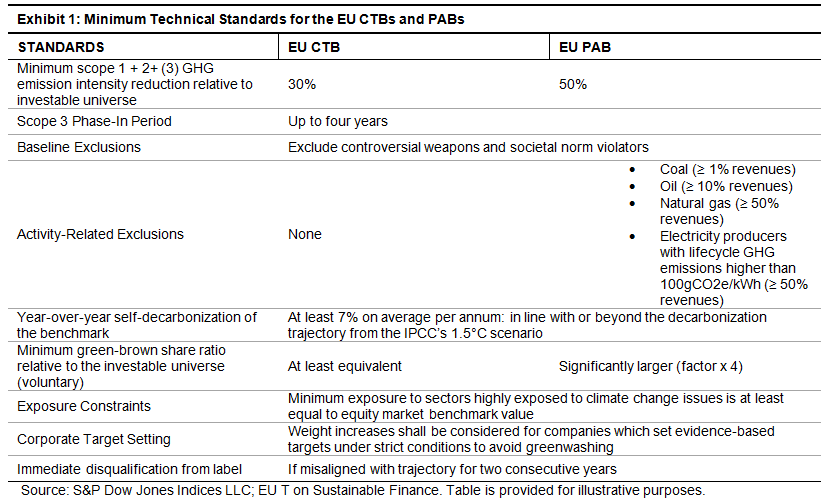

The EU’s action plan for financing sustainable growth proposes two new climate benchmarks: EU Climate-Transition Benchmarks (CTB) and EU Paris-Aligned Benchmarks (PAB), both using absolute measures to align with a 1.5°C trajectory rather than simply a relative carbon reduction. In 2019, an EU-appointed technical expert group (TEG) published a final report, which contains the proposed minimum standards. The final report will serve as the basis for the European Commission’s drafting of the delegated acts.

TCFD Recommendations

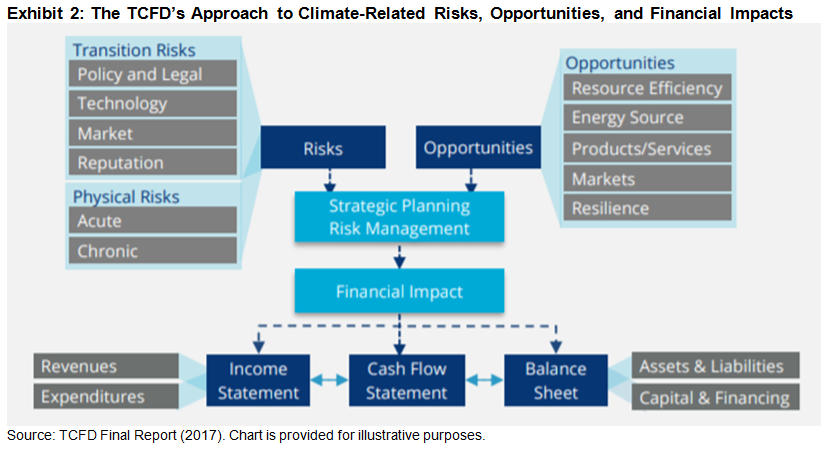

Two years prior, the TCFD released its recommendations for climate-related financial disclosures.[3] These include the financial impacts of climate-related risks and opportunities, comprising transition and physical risks (see Exhibit 2). The latter refers to physical hazards, for instance, more frequent and extreme weather events (storms, hurricanes, floods, etc.), weather pattern shifts, and sea-level rise. Physical risk thereby threatens companies facing asset-write downs, disruptions in supply chains, and costly insurance premiums,[4] whereas transition risk addresses the costs associated with the policy, legal, technological, market, and reputational risks from adapting to climate change. Conversely, the transition will also require USD 1 trillion of investment each year in gainful areas such as low-carbon energy and sustainable products.[5]

However, transition and physical risks are not a priori connected. The failure to transition to a low-carbon economy increases the likelihood and severity of physical risks, while the failure to mitigate physical risks suggests the market is not transitioning. Even under a 1.5°C scenario, physical risks will occur more frequently than at-present. A TCFD-aligned strategy must therefore account for both types of risk and the opportunities arising from climate change.

S&P Paris-Aligned Climate Index Concept

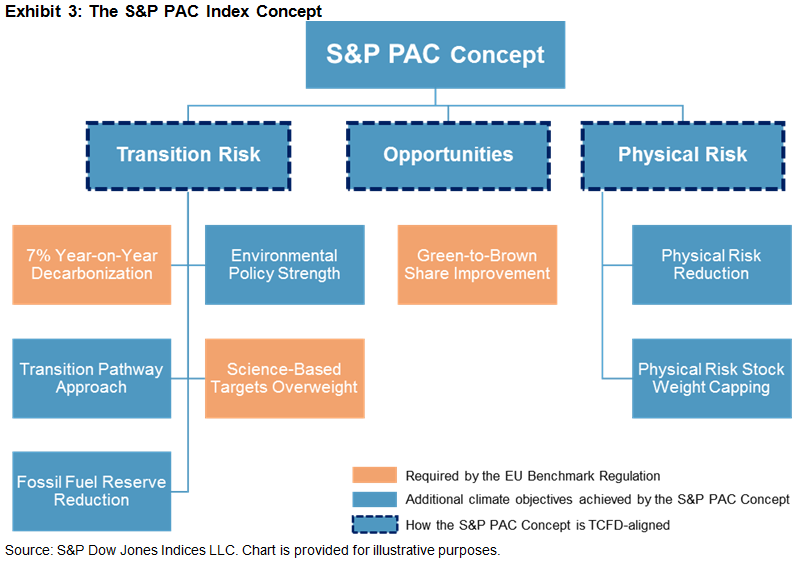

To meet the proposed EU regulation, S&P Dow Jones Indices has devised a new PAC Index Concept,[6] which additionally encompasses further objectives to align with a 1.5°C scenario and the TCFD.

- Transition Risk: The concept weights companies based on their ability to transition in alignment with a 1.5°C scenario, using Trucost data with transition-pathway models endorsed by the Science-Based Targets Initiative. Further measures include 7% year-over-year decarbonization to avoid overshoot, overweighting companies with strong environmental policies arguably better positioned for the transition,[7] overweighting companies that disclose science-based targets,[8] and reducing fossil fuel reserve exposure to mitigate stranded asset risk.

- Physical Risk: The concept achieves a 10% reduction in physical risk exposure using state-of-the-art Trucost data, accounting for geolocation-specific risk and sensitivity of company assets to climate hazards.[9] Dynamic capping of individual company weights based on physical risk exposure also reduces tail risk.

- Climate Opportunities: By improving the green-to-brown ratio relative to the underlying index, the S&P PAC Index Concept exhibits greater exposure to green power generation sectors expected to benefit from the transition.

These objectives are simultaneously incorporated while minimizing deviations from the underlying index, resulting in a broad, diversified index with similar performance to that of the underlying benchmark. The S&P PAC Index Concept thus offers a formidable new tool for meeting the proposed EU regulation—as well as a resilient and holistic approach to addressing climate risks and opportunities, as per the TCFD.

[1] The aim of the Paris Agreement is to strengthen the global response to the threat of climate change by keeping global temperature rise well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5°C—see here. According to the Intergovernmental Panel on Climate Change (IPCC), climate adaptation will be less difficult under a 1.5°C scenario, as “our world will suffer less negative impacts on intensity and frequency of extreme events, on resources, ecosystems, biodiversity, food security, cities, tourism, and carbon removal”—see here.

[2] In May 2018, the EU announced proposals to create two new climate benchmarks as part of its action plan for financing sustainable growth. In December 2018, the law creating these new benchmarks was officially enacted via amendment EU 2019/2089. An EU-appointed TEG later published its final report on climate benchmarks and benchmark ESG disclosure in September 2019, containing proposed minimum technical standards for these benchmarks that are still at the proposal stage. The report provides proposals to the European Commission that will be used to prepare the delegated acts.

[3] See Final Report: Recommendations of the TCFD (June 2017), available here.

[4] For example, in an attempt to curb global emissions, carbon taxes and emission trading schemes are increasing operating costs for carbon-intensive companies, while the substitution of existing products or technologies to lower carbon alternatives creates technology risk amid possible early retirement of assets. Further, shifts in consumer preferences for low-carbon substitutes and reputational damage to companies that are slow to adapt can erode brand value and ultimately decrease company revenues.

[5] TCFD Final Report (June 2017), Executive Summary Page ii, available here.

[6] For full details of the proposed S&P PAC Index Concept, see here.

[7] The S&P PAC Index Concept ensures improved environmental policy credentials, as measured by S&P DJI Environmental Scores. The scores provide insights into financially material aspects of a company’s climate strategy, environmental policy and management systems, electricity generation, environmental business risks and opportunities, low-carbon strategy, recycling strategy, co-processing, and more. To learn more about S&P DJI Environmental and ESG Scores, visit https://spdji.com/topic/esg-scores.

[8] Subject to the conditions specified by the TEG to prevent greenwashing and encourage disclosure.

[9] Trucost physical climate risk data covers hazards related to wildfires, cold waves, heat waves, water stress, sea-level risk, floods, and hurricanes. To learn more about Trucost physical climate risk data, see here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.